Cosmos Atom’s technical analysis shows that after the September 9th high, ATOM is down more than 43%, which indicates some caution for ATOM holders. In addition, Osmosis liquidity has decreased from 282 million to 178 million, a 37% decrease, which is approximately the same level as on June 12, 2022.

According to the weekly timeframe, ATOM is now transitioning from an uptrend to a downtrend, as shown in the chart below: following the Luna incident, ATOM declined $5.6 and then moved up; on September 9, ATOM touched $17, so going forward, it is now in a downtrend in the daily and weekly time frames.

Cosmos ATOM Technical Analysis Bottom June 18

ATOM made a new all-time low on June 18 at a price of $5.5; at this point, Atom made a bottom because Cosmos is covering quickly, like more than 3X from the June low, and this astounding price surged in less than three months.

So, what happened now? Why is the price of the atom falling today, and what is the main reason for this? Before answering this question, let’s first see the social traffic and osmosis liquidity.

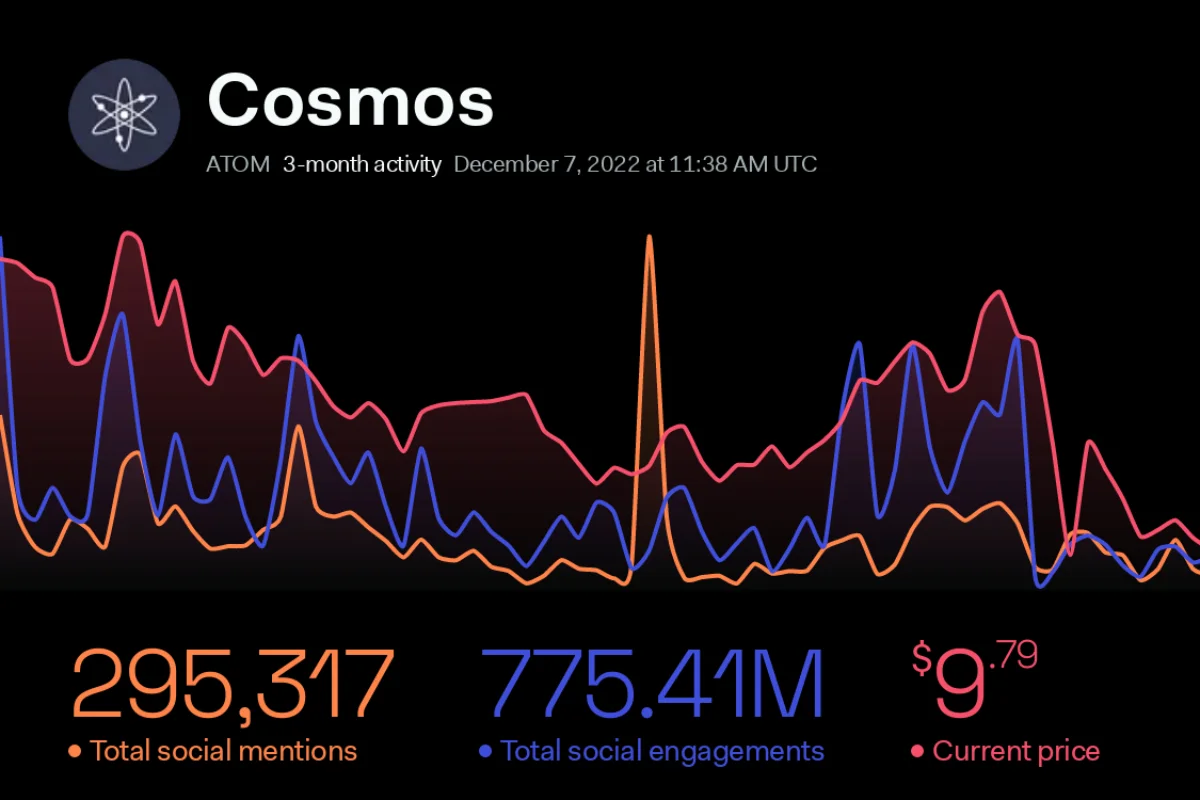

Social Volume Of Cosmos Atom

Social volume analysis is a component of fundamental analysis because it allows us to see what actual people are talking about when they discuss whose crypto project it is. According to LunarCrush Atom’s three-month social volume, people are less interested in discussing Atom after September 9.

If we see the Osmosis volume after the 9 September we can see more interesting facts. Osmosis is main component of Cosmos Hub and Decentralized Exchange.

Osmosis Liquadity

Osmosis (OSMO) is a decentralised exchange (DEX) for Cosmos, which is an ecosystem of sovereign, interoperable blockchains that are all connected without trust over IBC, the Inter-Blockchain Communication Protocol. Osmosis also has assets from the Ethereum and Polkadot ecosystems that are not IBC assets. Osmosis used to be based on pools like Balancer, but now it is switching to a more sustainable concentrated liquidity model that makes trading and providing liquidity better.

On September 9, the ATOM price fell, but liquidity volume increased from the June low level. After the FTX SAGA, liquidity volume slipped, and this time the Osmosis volume is declining to around the June 12 level.

Read More: Story Behind FTX Exchange and Alameda Research Collapse

If we see the all event which effect Atom so let’s jump into the last chart

Cosmos Atom Chart Analysis with Events

The atom price fell from $15 due to the FTX drama, which began on November 6 with the CZ tweet and culminated on November 9 with the FTX and FTT collapses. Atom priced decline around 40% in just 3 days then after couple of days Cosmos community reject atom 2.0 whitepaper which is happed on 14 November after FTX Collapse then the price of atom still resist the $10.5 level.

After four rejections from the $10.5 level, let’s see if Atom can hold crucial support; if not, we can expect a free fall downfall to $7.

More than 33.4% of votes were cast without a Veto (the right to overturn or withdraw a decision, which is 37.39%).

We voted NoWithVeto on Prop 82.

The reasons are as follows. pic.twitter.com/Khh92jgjXQ— Takumi Asano 朝野巧己 / h+JP / GAME (@takumiasano_jp) November 14, 2022

Closing Though

In my opinion, the rejection of Atom 2.0 is bad news, and we’ve seen multiple rejections from $10.5; I’m short when it’s at $10.5, but now that we’ve seen the FOMOC, I’ll decide whether to stay short.

Read this article for upcoming US CPI numbers Federal Reserve hikes 75bps interest rate? Stocks Analysis After US jobs report

Disclaimer

This content contains an opinion and is solely for informational reasons. It is not intended to be financial or investment advice. Seek investment/financial guidance from a properly licensed specialist. I have no affiliation with any of the companies whose coins are referenced in this article. Please always conduct thorough research prior to investing, as you are solely responsible for any capital-related decisions you make and the outcomes.