GMX Crypto Price Prediction

What is the GMX crypto Price in the Future? Before we knew what is GMX crypto, Let’s start with the founding team.

The people who started GMX don’t want to be known. But it is known that the team has done two other successful launches of protocols before, with XVIX and Gambit.

The team is also working hard to put together a new AMM called X4.

From what I can tell, it looks like X is the main developer.

So first we talk about GMX crypto then we look at the price predictions in long term so let’s deep dive into GMX.

What is GMX crypto

GMX is a spot and perpetual DEX with low swap fees and trades that have no effect on the price. GMX is the native governance & utility token

What is DEX and Why GMX is different?

A DEX is an app built on top of one or more blockchains that lets people send and receive money from each other. DEXs, let people buy, sell, and trade cryptocurrencies without going through a central bank.

These exchanges don’t hold the user’s assets, so the user still owns them and decides what happens to them. Uniswap, dYdX, Serum, Curve, and Dexalot are some of the most well-known DEXs.

How do decentralized exchanges work?

On DEXs, traders store funds and make trades by interacting with self-executing smart contracts. These are codes that trigger different outputs when given certain inputs.

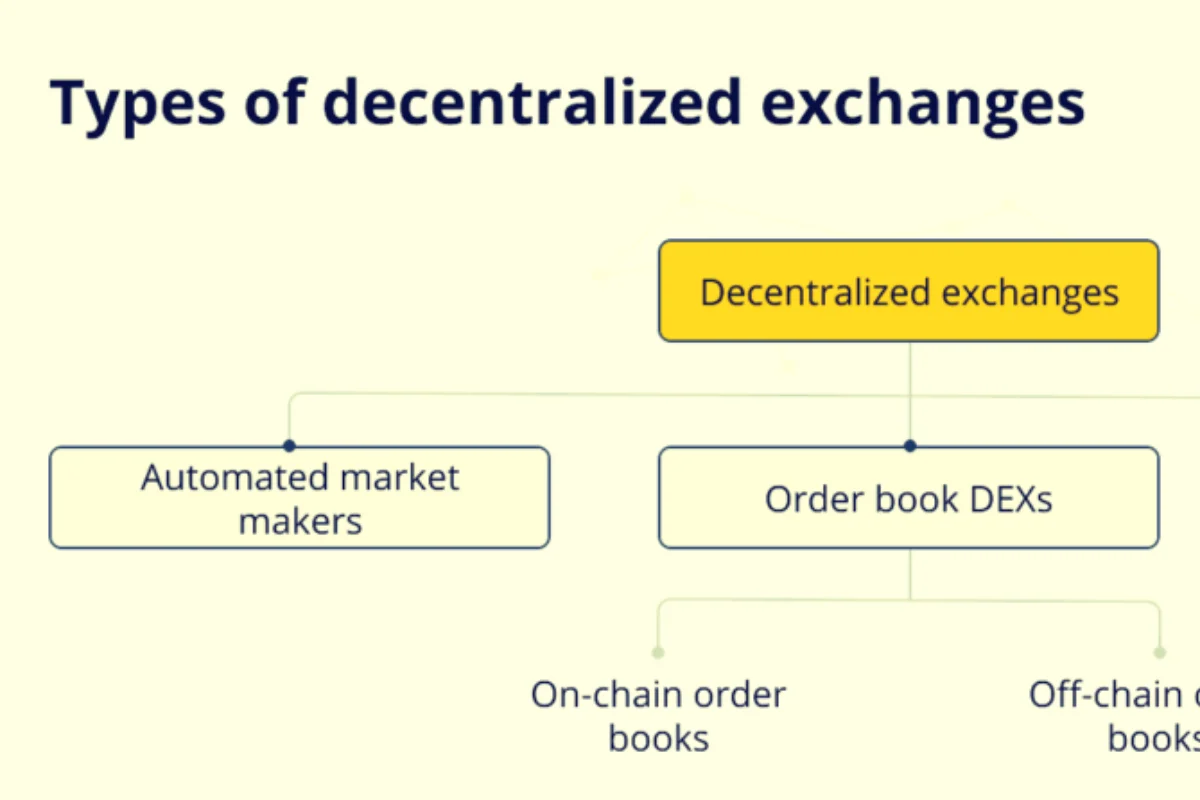

There are three kinds of DEXs: order book DEXs, Automated Market Makers, and DEX aggregators. All of them have smart contracts that let users trade tokens, but they are based on slightly different ideas.

There are many different DEX designs, and each one has different features. Order book DEXs and automated market makers are the two most common types (AMMs). DEX aggregators, which search through multiple DEXs on-chain to find the best price or lowest gas cost for the user’s desired transaction, are also a popular category.

Users usually have to pay two types of fees when they use DEX: network fees and trading fees. Network fees are the cost of the gas used for the transaction on the blockchain. Trading fees are collected by the underlying protocol, its liquidity providers, token holders, or a combination of these, depending on how the protocol is designed.

The goal of many DEXs is to have a permissionless, end-to-end, on-chain infrastructure with no single points of failure and ownership that are spread out among a community of different stakeholders. This usually means that a decentralized autonomous organization (DAO) made up of a community of stakeholders votes on important protocol decisions.

Order book DEXs

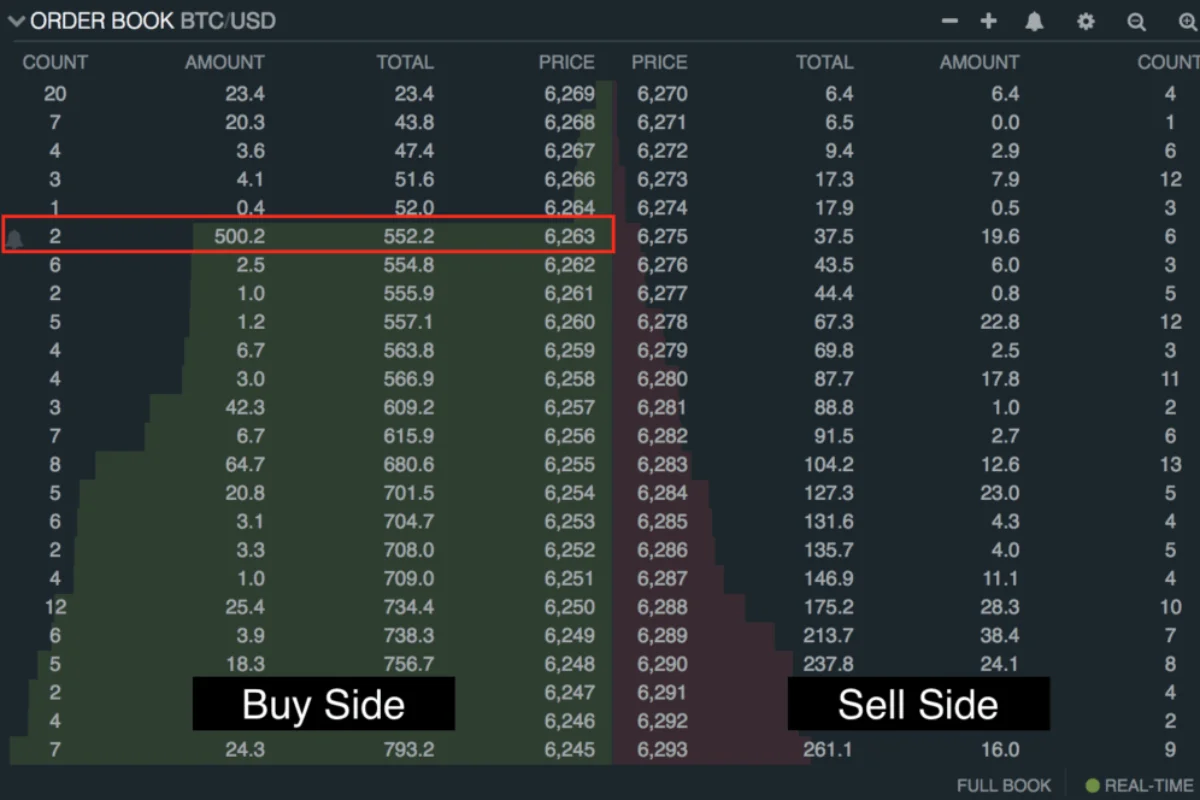

The order book is the backbone of electronic exchanges; it is a database that stores all active buy and sell orders in a market in real-time. Order books let the internal systems of an exchange match buy and sell orders.

Every centralized exchange uses a traditional order book model that depends on market makers to provide liquidity. An order book shows how much of an asset is being offered or bid on at each price point. This is called market depth.

Not only centralized exchanges are affected by this. In fact, the same model is used by some decentralized exchanges (dYdX).

Here’s what I mean: Say you wanted to buy BTC for $10,000 USD. Someone must be willing to sell their $BTC on that platform at that price for this to happen. Your buy order would not go through if there was no willing seller.

Order book models work best when there are a lot of buyers and sellers on the market. But this model has a lot of problems, especially when it comes to crypto. They are expensive to run and need people to act as market makers, who need to be paid in some way.

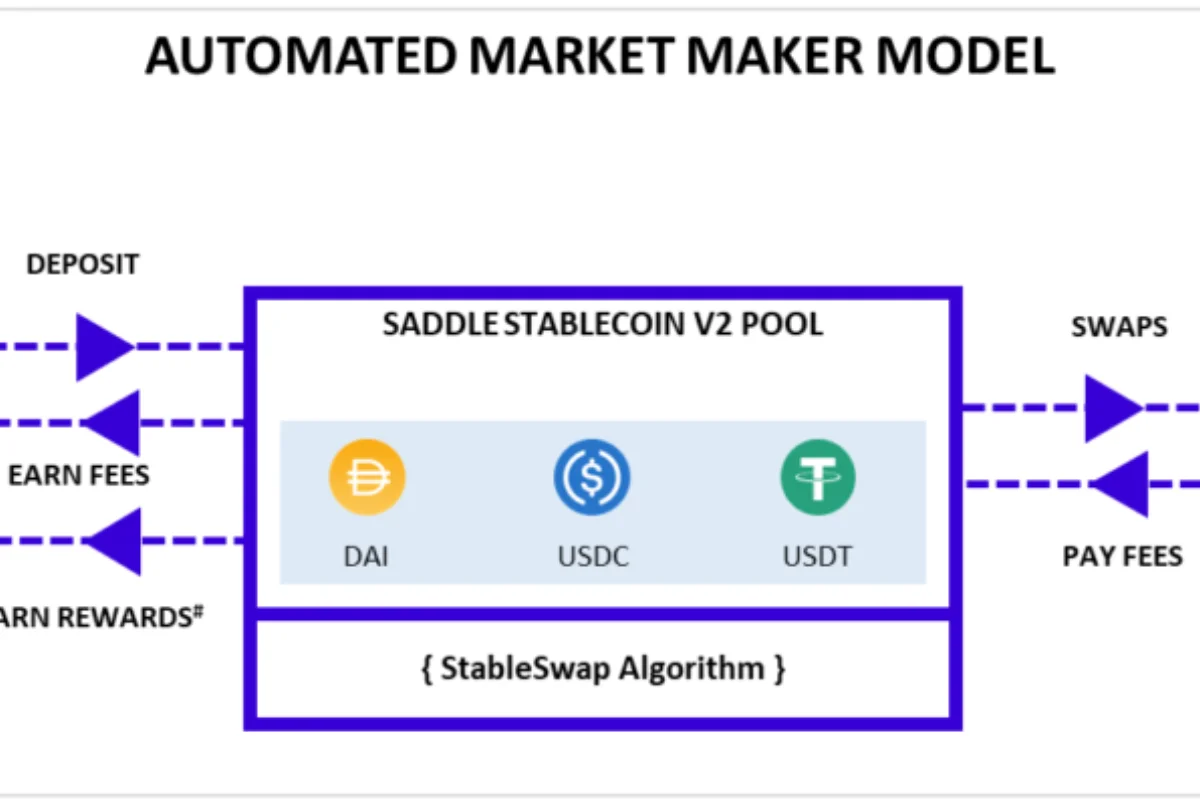

Here’s the solution: Automated Market Maker (AMM).

Automated Market Maker (AMM)

Automated market makers are the most popular type of DEX because they offer instant liquidity, open up access to liquidity providers, and, in many cases, let anyone create a market for any token without permission. An AMM is basically a money robot that is always willing to quote a price between two or more assets. An AMM doesn’t have an order book. Instead, it has a liquidity pool that users can use to swap their tokens. The price is set by an algorithm based on how many tokens are in the liquidity pool.

GLP Liquidity Model

There are centralized markets in the perpetual market, such as Binance, FTX, BitMex, or Bybit, and decentralized markets, such as dYdX, Perpetual Protocol, or GMX. (Still, most trades of things that don’t end are done in centralized exchanges.)

By far, dYdX has the most market share in the decentralized perpetual market. They took advantage of the benefits of StarkEx, which is Starkware’s layer 2 solution below Ethereum based on Zk-rollup.

Even though dYdX was widely used, the price of the $DYDX governance token dropped by a lot. Mainly because they don’t have a way to reward people based on how much money the dYdX service makes.

Since a while ago, GMX has been a solid number 2 in the decentralized perpetual market, with a market volume that is greater than that of Perpetual Protocol. GMX’s vAMM is based on Oracles, while dYdX’s trading is still based on a central order book.

GMX separates out from its competition by rewarding and bootstrapping exchange liquidity. $GLP, the protocol’s liquidity token, is used.

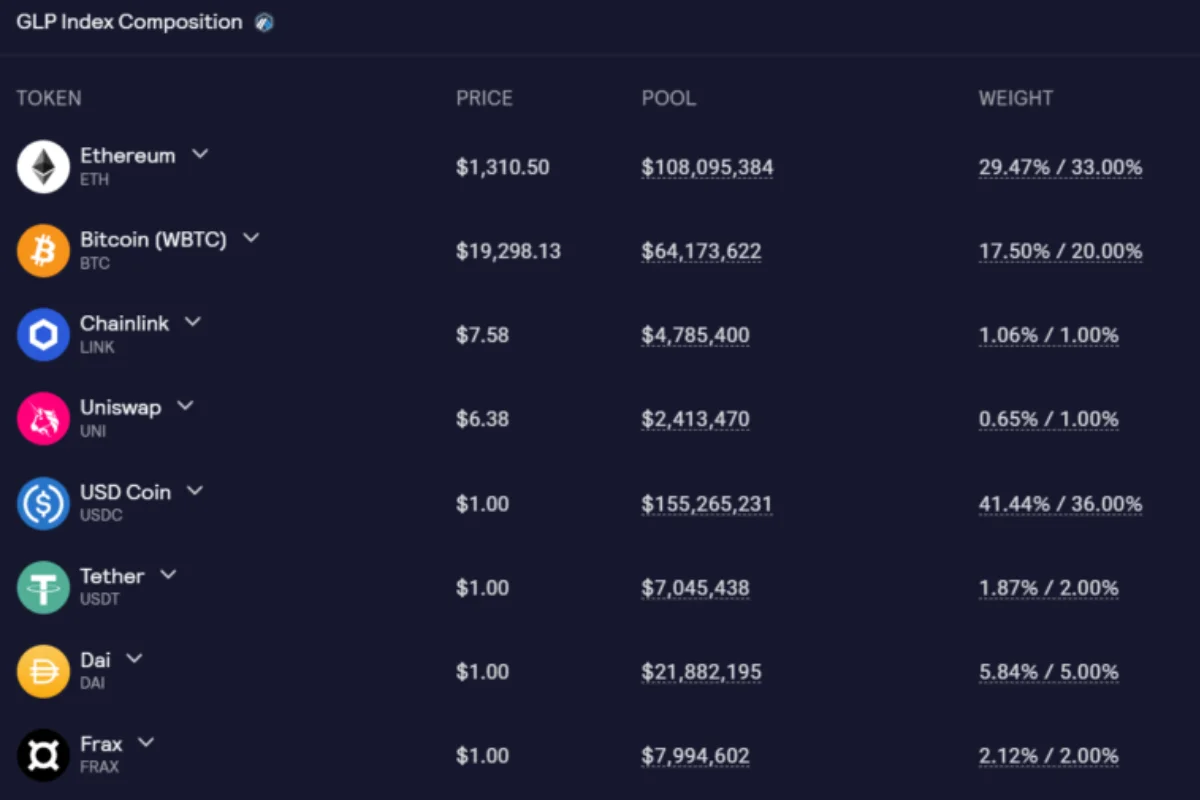

GLP Index Composition includes swaps and leverage assets. GLP can be created by depositing any index asset and redeeming it for another.

GLP holders have access to all of these assets, trading fees, and $esGMX token incentives.

- Arbitrum GLP holders receive escrowed GMX and 70% of platform fees in $ETH.

- $GLP holders on Avalanche earn escrowed GMX + 70% of platform fees in $AVAX.

Before being redeemed, GLP tokens must be held for 15 minutes. Here’s more about GLP mechanics.

Arbitrum and Avalanche GLP are incompatible and non-transferable.

$GLP and $GMX split protocol revenue 70/30. $GLP holders also obtain all the collateral when positions are liquidated, leading to a volatile but growing revenue stream.

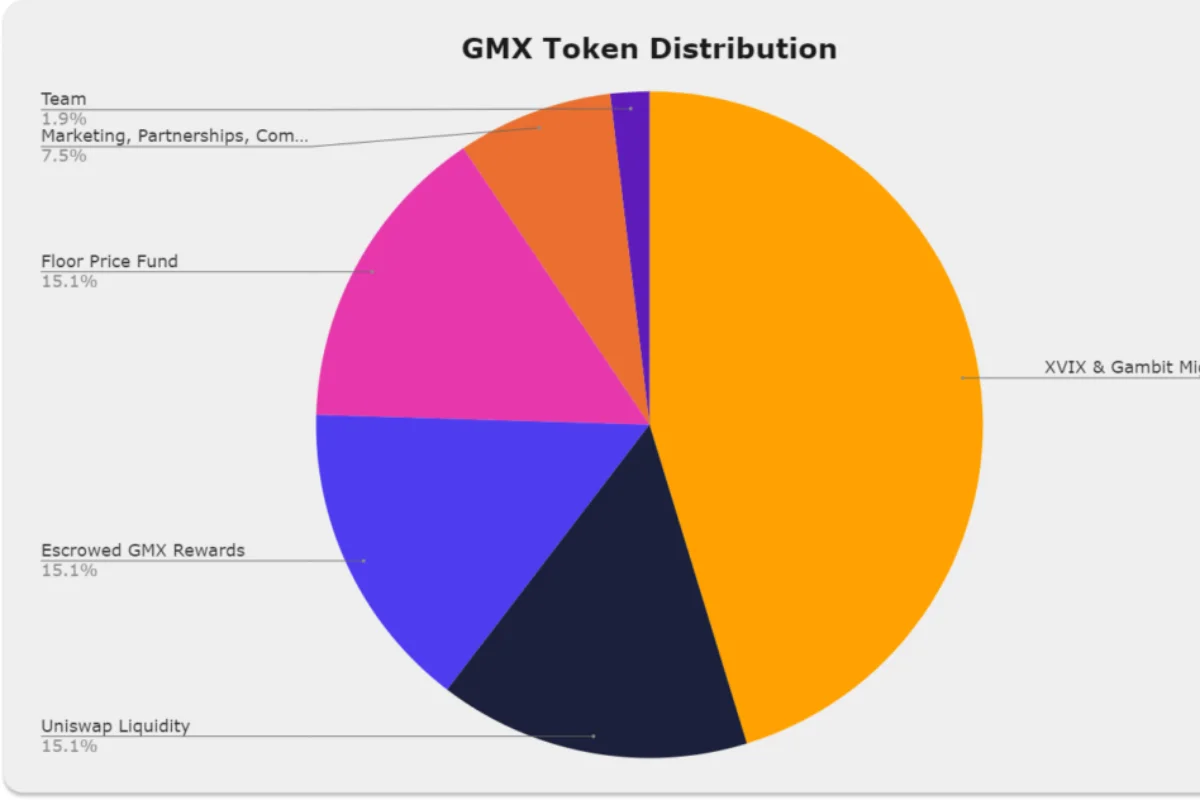

Tokennomic

GMX is the utility token and governance token for the protocol. $GMX is expected to have a maximum supply of 13.25 million tokens. This number can go up if more products come out and more liquidity mining is needed. But there will be a vote on governance before any changes are made.

Here’s how the 13.25 million $GMX tokens will be divided up:

- 6 million GMX from the XVIX and Gambit migration.

- 2 million GMX paired with ETH for liquidity on Uniswap.

- 2 million GMX reserved for vesting from Escrowed GMX rewards.

- 2 million GMX tokens to be managed by the floor price fund.

- 1 million GMX tokens reserved for marketing, partnerships, and community developers.

- 250,000 GMX tokens distributed to contributors linearly over 2 years.

Most tokens (45,3%) were given to holders of XVIX and GMT (Gambit) tokens so that they could move to the new system. In order to move, the original assets (XVIX, XLGE, and GMT) were traded for $GMX at a price of 1 $GMX = $2 USD.

The Floor Price Fund is a feature of the $GMX token that makes it unique. This fund is worth $ETH and $GLP, and it grows in two ways:

1- The protocol provides and owns the GMX/ETH liquidity. The fees from this trading pair will be turned into GLP and put into the floor price fund.

2- Half of the money from Olympus bonds goes to the floor price fund, and the other half is spent on marketing.

The floor price fund helps to keep GLP liquid and gives those who staked $GMX a steady flow of $ETH rewards.

As the floor price fund grows, it can be used to buy back and burn GMX if (Floor Price Fund)/(Total Supply of GMX) is less than the market price of $GMX. This gives $GMX a minimum price floor in terms of $ETH and $GLP.

Read More: Bitcoin Layer-2 Lightning Network capacity hit 5,000 BTC

TVL & NFT Real Yield Feature

The largest market in the world is the market for derivatives. As of May 2022, 61.7% of the volume of crypto traded was in crypto derivatives, and this number is still growing. This shows that, even though the market is in a bad place right now, people still want derivative products like perpetual.

So, GMX is in a good position to keep growing its platform because it has low fees and quick transactions, which are important for user satisfaction and retention. The upcoming X4 should make it possible for other projects to build on top of GMX, which will help the protocol reach more people and get more users.

Also, 83% of the current supply is staked on the platform, which shows that investors believe in the project even though the market is down.

GMX Blueberry Club

The GMX Blueberry Club (GBC) is a group of 10,000 NFTs on Arbitrum that were made for the GMX.io community and have a blueberry symbol.

Part of this collection will be given away for free in December 2021, and the rest will be sold to the public for 0.03 ETH per NFT.

The Real Yield feature is mostly shown by the way this project’s profits are used to give rewards.

All of the money made from the sale of the GBC to the public will be used to start the Community Treasury. The fund is run by a voting system (each GBC gives one vote), and the only assets are GMX and GLP tokens on the Arbitrum and Avalance blockchains.

When users stake NFT GBCs, the profits made by the Community Treasury will be given back to them as esGMX tokens, which can be used for trading.

At the moment, there are only about 1,228,190 USD staked on the platform, which isn’t a lot compared to what the GMX ecosystem could be and how it could grow over time.

where do the rewards that cost money come from?

- GMX and GLP did business

- 2.5% of each transaction is what NFT GBC gets in royalties.

- Blueberry Lab, a tool that lets users change how new properties work in their NFT, is working more closely with big events and brands. All of the money made from this sale will go into the Community Treasury, which is used to give users more rewards.

- Earn money from Yield Farming investments and cash flow (LP)

GMX Crypto Price Prediction

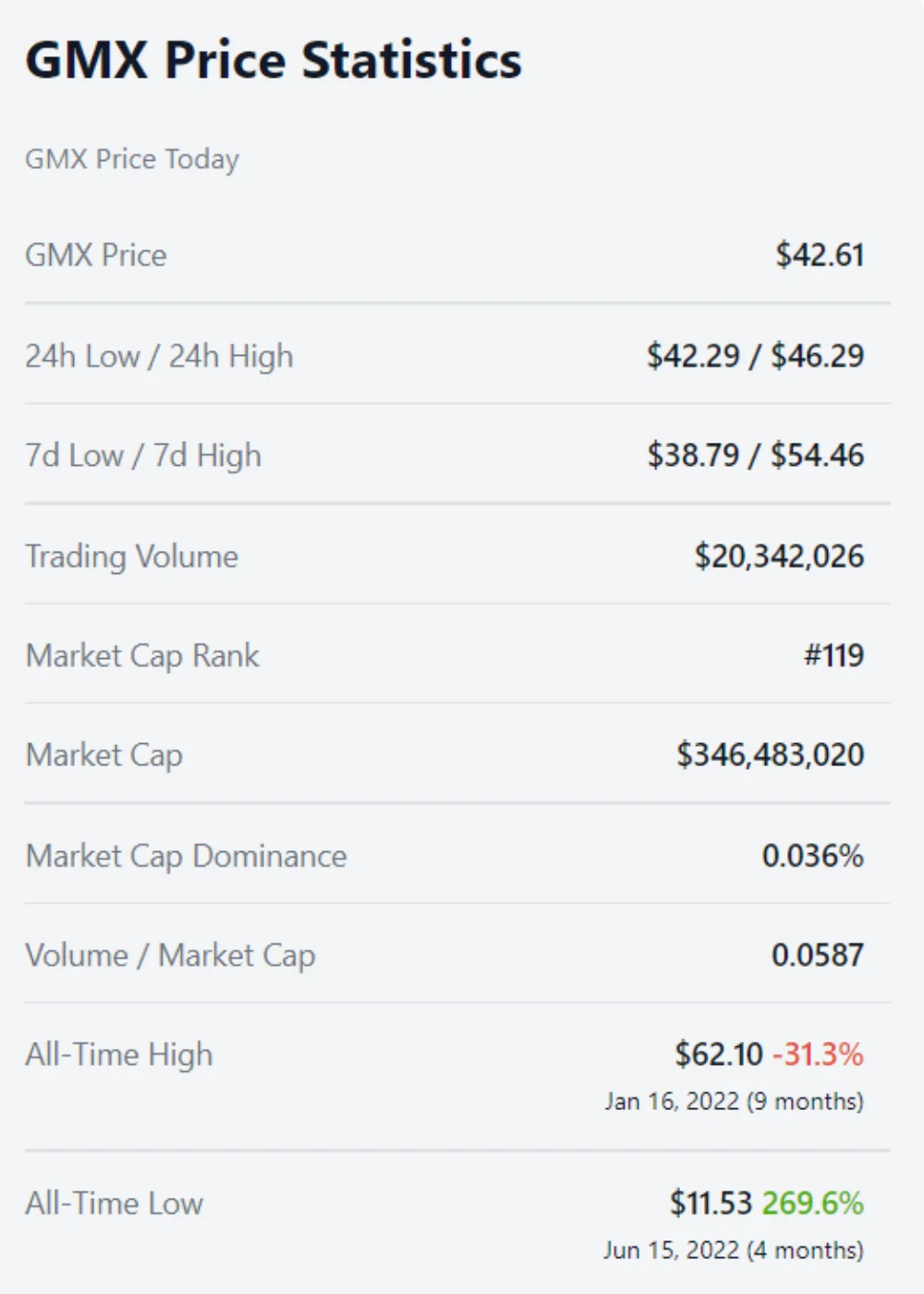

At this current time down 31% at an all-time high (ATH) and 269% up from an all-time low (ATL). Long-term Price Prediction for GMX: Below is a look at how the price of GMX might change in the future. GMX was last seen trading at $42.37. It has a market cap of $344,227,425 and $20,149,252 in trading volume. GMX can figure out what the price will be by looking at how it has changed in the past, what is happening now, and how people feel about it.

GMX crypto price prediction 2022: Based on our research, the price of GMX in 2022 should be between $29.95 and $44.92, with an average price of about $37.43.

GMX crypto price prediction 2023: Based on our research, the price of GMX in 2022 should be between $59.91 and $89.92, with an average price of about $74.91.

GMX crypto price prediction 2024: Based on our research, the price of GMX in 2022 should be between $78.95 and $117.92, with an average price of about $98.43.

GMX crypto price prediction 2025: Based on our research, the price of GMX in 2022 should be between $29.95 and $44.92, with an average price of about $37.43.

GMX crypto price prediction 2026: Based on our research, the price of GMX in 2022 should be between $102.95 and $154.92, with an average price of about $128.43.

GMX crypto price prediction 2027: Based on our research, the price of GMX in 2022 should be between $143.95 and $202.92, with an average price of about $168.43.

GMX crypto price prediction 2028: Based on our research, the price of GMX in 2022 should be between $176.95 and $264.92, with an average price of about $220.43.

GMX crypto price prediction 2029: Based on our research, the price of GMX in 2022 should be between $231.95 and $346.92, with an average price of about $289.43.

GMX crypto price prediction 2030: Based on our research, the price of GMX in 2022 should be between $302.95 and $454.92, with an average price of about $378.43.

Disclaimer

I am not a financial advisor. Do your own research. Consult a professional investment advisor before making any investment decisions!