Starting from a hedge fund in earlier November 2017 Sam Bankman-Fried (SBF) Founded the hedge fund Alameda research he becomes more successful in trading and investing in new projects in crypto.

In April 2019 SBF founded the FTX exchange and he become a more well-known personality in crypto in 2021 bull market saw the FTX exchange rise to prominence to become the second largest exchange in the world and overtaking the earlier establish competitors like Gemini, Coinbase, and Kraken.

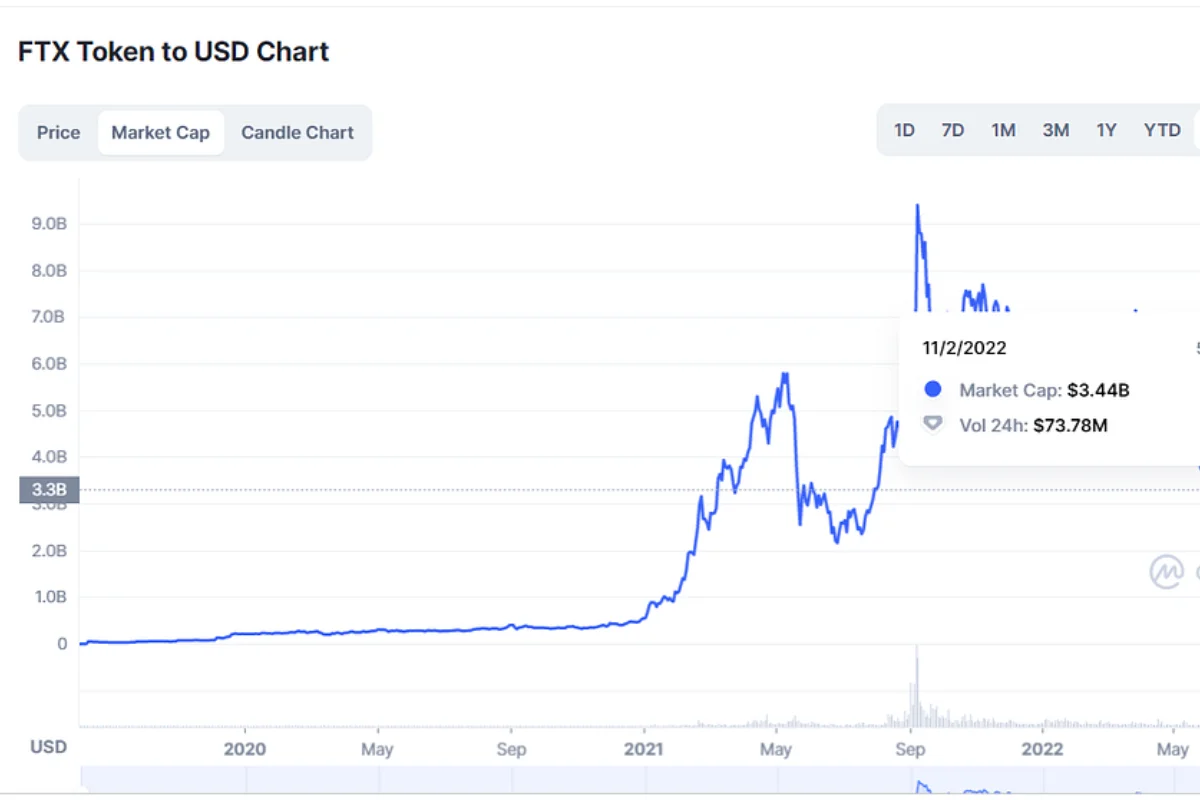

FTT is a native token of FTX exchange and is generally associated with the value of the crypto exchange. If you’re trading on FTX and you want to minizine the trading fees So FTT gives you a discount on trading fees, commissions, and rewards, similar to the BNB token on Binance.

But Here BNB is not collateral of Binance exchange and BNB also has utility So we don’t compare FTT with BNB. we will talk more about it later in this article.

In May 2022 after the luna crashed FTX was widely seen to have cemented its leadership, launching offers to bail out entities like Voyager, Celsius, and BlockFi. Meanwhile, SBF became headlines in business media.

Now Today Alameda Research collapsed and FTX went insolvent. Here’s everything you need to know about Alameda Research and the collapse of FTX.

November 2nd Wednesday: Alameda’s Balance Sheet

The beginning volatile saga in the crypto market starts on November 2nd when Coindesk reported details from a “private document” dated 30th June 2022, revealing Alameda’s sheets fully loaded with FTT tokens.

Coindesk’s discovery that most of Alameda’s assets ($5.8 billion out of the reported $14.6 billion) were in FTX’s own exchange token $FTT was a big hint that something was wrong.

This was a worrying sign because the price of FTT would drop if Alameda tried to sell it to get cash. In short, Alameda used FTT as security for their loans by putting it up as collateral.

FTX Exchange and Alameda Research hold 8 billion in FTT value which is illiquid against a real market cap of 3.4 billion. That is 4.6 billion of magic money they report on their balance sheet.

November 6th Sunday Alameda CEO Caroline Ellison & CZ on Twitter

By November 6, there were a lot of rumors going around. CEO Caroline Ellison of Alameda had to step in to calm industry worries about the fund’s solvency because of the talk. She said on Twitter that the CoinDesk report doesn’t show assets worth more than $10 billion.

A few notes on the balance sheet info that has been circulating recently:

– that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there— Caroline (@carolinecapital) November 6, 2022

Caroline believes that everyone in crypto does not use their minds and that she misled the market by believing that all of the 10 billion assets are saved, but they invest in different crypto assets, such as the $292 million $SOL assets and other assets in the Solana ecosystem such as SRM, MLP, and so on.

We all know Luna crashed. Luna founder Do Kwon made the same mistake in the Luna Foundation; they all invested in BTC and many others, such as Avax, when the situation resembled a bank run, so the Luna Foundation sold its BTC, the market panicked, and many other firms, such as 3AC, Celsius, Voyager, and BlockFi, collapsed because they also huge invested in Luna tokens.

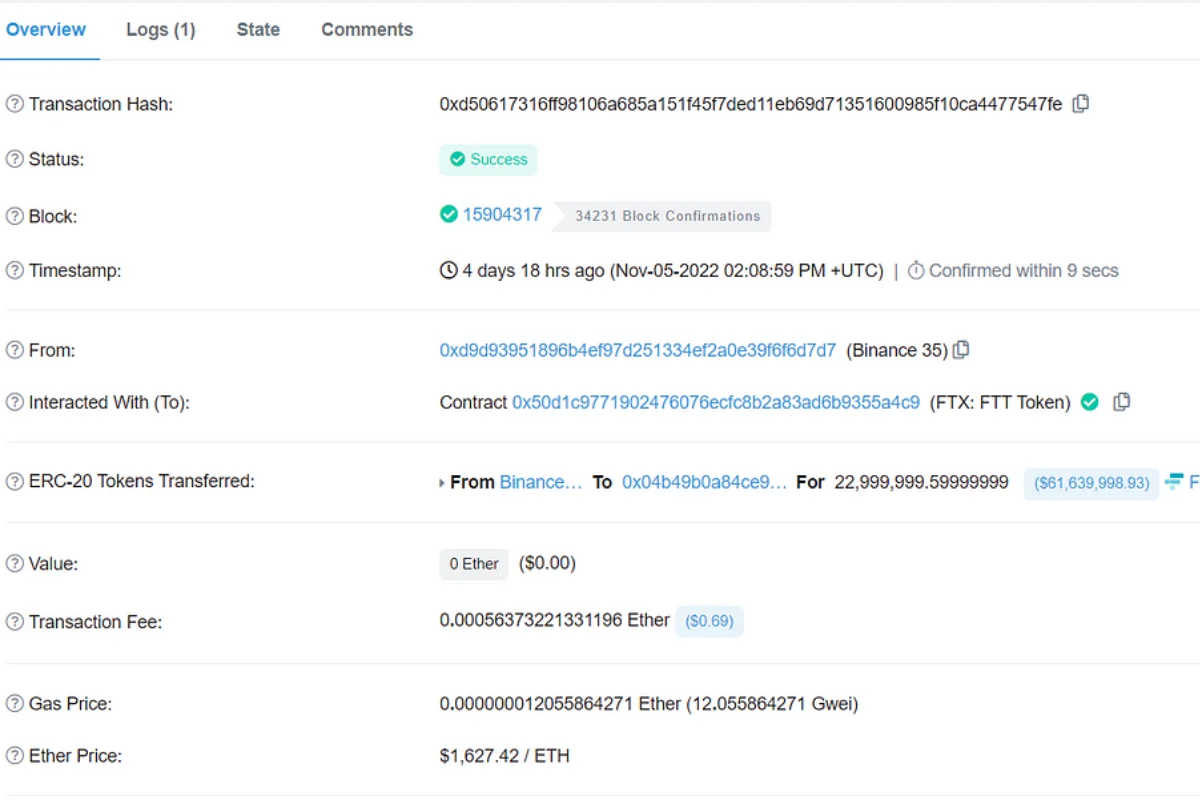

Just an hour after the tweet from the CEO of Alameda, the CEO of Binance, CZ, said that the company was selling $2.1 billion worth of FTT. Binance was given a lot of FTT after they stopped being shareholders in FTX last year. The tweet was written in a diplomatic way, saying that Binance was “responsibly” going about business as usual. But the timing of the announcement and the fact that it was made public just made rumors and investor worries worse.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

November 7 Monday: The drama starts So grab your PopCorns

Caroline from Alameda then offered to buy the FTT OTC for $22 to lower the price impact. It was strange for her to say the price level out loud since she could have bought at any price lower than that. FTT was still well in the $23–25 price range.

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

CZ politely declined

I didn't say that. It was a question, not a commitment. I think we will stay in the free market.

We still hold LUNA (now LUNC) today. 😂

— CZ 🔶 Binance (@cz_binance) November 7, 2022

On November 6, when CZ tweeted that Binance was exiting FTT, he had already transferred $580 million worth of FTT from an unknown wallet to Binance.

Yes, this is part of it. https://t.co/TnMSqRTutr

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Everyone wants more transparency in our industry, right? My tweets were simple. There were questions about a large ($580m) FTT deposit to Binance, and we were transparent about the fact that we are closing our FTT position. 2/4

— CZ 🔶 Binance (@cz_binance) November 7, 2022

Was CZ “attacking” its main competitor? No, says CZ. This is just standard “post-exit risk management, learning from LUNA” on the part of Binance. Except that the tone of his next tweet was very different from the tone of his previous tweet.

By saying “LUNA,” FTT was put in the same bad light as the now-hated Terra coin.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

CZ included SBF is lobbying against other crypto industry players we don’t support

Midterms are in 8 days.

Here are the largest donors so far in the 2022 midterms:

– George Soros with over 120 mln

– Elizabeth and Richard Uihlein at over 80 mln

– Ken Griffin of Citadel with nearly 70 mln

– Sam Bankman with nearly 50 mln

– Michael Bloomberg +20 mlnIncredible. pic.twitter.com/Oc5SdLPBL7

— unusual_whales (@unusual_whales) October 31, 2022

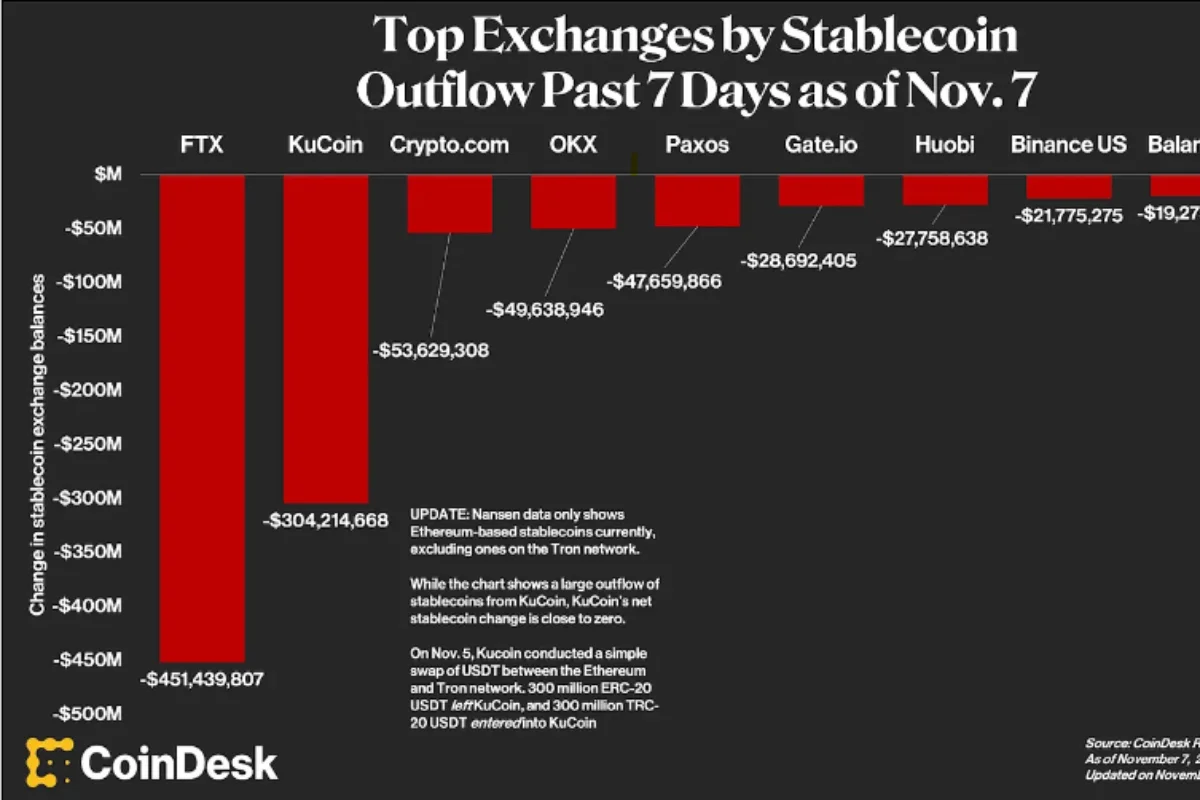

At this point, any investor with a brain had to take the rumors seriously, even if they hadn’t before. Users of FTX rushed to get their money out, and $451 million worth of stablecoins have left the exchange in the last seven days.

After that, institutional traders did the same. At the same time, on-chain wallet activity showed that Alameda Research sent about $321 million in stablecoins to FTX. This was likely to make it easier for users to withdraw their funds.

At this point, SBF tried to calm the market down with a tweet that has since been deleted:

A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine. FTX has enough to cover all client holdings.

2) A bunch of unfounded rumors have been circulating. You can see https://t.co/EBmqPhqCBl.

FTX keeps audited financials etc. And, though it slows us down sometimes on product, we're highly regulated.

— SBF (@SBF_FTX) November 6, 2022

Here I told facts about FTT as a shit coin because they don’t have utility SBF compares BNB to FTT this is holy shit because BNB itself has more than utility instead of Binance trading fees.

November 8 Tuesday

By Tuesday, FTT had fallen well below the price of $22 that Alameda Research CEO Caroline had offered to buy it for. It had dropped to about $15. If what CoinDesk says about Alameda’s balance sheets is true, the fund is most likely bankrupt by now because it has a lot of FTT.

At this point, there was a very loud silence from FTX.

November 9 Wednesday: FTX gives up

After being silent for more than 24 hours, SBF came back out, giving up.

“Hey all: I have a few announcements to make. Things have come full circle, and FTX.com’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for FTX.com (pending DD etc.).”

Changpeng Zhao, Binance, and FTX made a deal a few minutes ago

Binance has signed an LOI (letter of intent) to acquire all of FTX.

The move will take time to complete as due diligence is taken care of. Binance does hold the right to pull out from the deal at any moment at its discretion.

CZ also added: “We expect FTT to be highly volatile in the coming days as things develop”.

Sam Bankman-Fried also tweeted: “We have come to an agreement on a strategic transaction with Binance for FTX.com”.

Hours later, Sam Trabucco, former CEO of Alameda waves the white flag.

Much love to everyone — I'm sure the past few days have been dark for many and I hope the road ahead is brighter.

— Sam Trabucco (@AlamedaTrabucco) November 8, 2022

The background behind collapse happing in August

However, in the background, there were some cracks starting to appear. Eyebrows started to raise when Alameda CEO Sam Trabucco suddenly resigned.

It's with the same goal that I'm announcing today that I am stepping down as co-CEO of Alameda Research — @carolinecapital will continue on as Alameda's CEO. I will stay on as an advisor, but otherwise will not continue to have a strong day-to-day presence at the company.

— Sam Trabucco (@AlamedaTrabucco) August 24, 2022

Additionally, a month later FTX President Brett Harrison stepped down.

1/ An announcement: I’m stepping down as President of @FTX_Official. Over the next few months I’ll be transferring my responsibilities and moving into an advisory role at the company.

— Brett Harrison (@BrettHarrison88) September 27, 2022

These resignations occurred just before it was revealed that FTX was facing some legal trouble in the form of a securities regulator probe.

Although public sentiment was becoming more negative towards Sam, the DCCPA draft bill marked a real turning point for the public’s perception.

November 10 Thursday Binance cancel the deal

Binance has canceled its plans to acquire FTX.

Per a statement from Binance: “Our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help”.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

On Chain Story

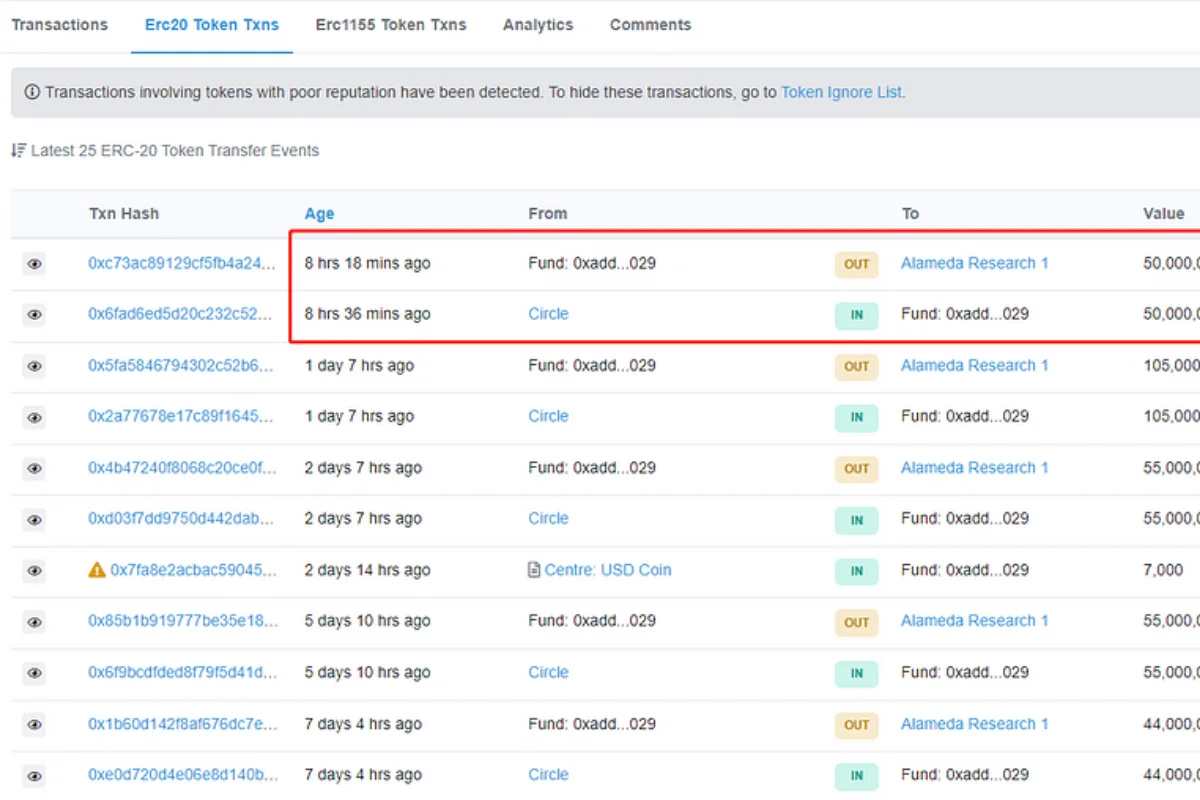

On Chain show, Alameda withdrew USDC from Circle while the user of FTX exchange is unable to withdraw assets from FTX this is actually a pain point for users.

But instead of transferring to the FTX exchange, she may transfer to Binance. you check this link below and analyse the on-chain metrics

SBF was a heavy investor in SOL and upcoming L1s like Aptos and Sui. Alameda’s balance sheet, most in the Solana ecosystem ($SRM, $OXY, $MAPS).

Solana hit hard because SBF sold to get more liquidity and many others of Alameda’s portfolio.

Read more: Solana Biggest Stake Change 49.61 Sol ($982M) unstake | Epoch 370 what’s next?

I leave readers with this open letter from CZ:

In the spirit of transparency, might as well share the actual note, sent to all Binance team globally a few hours ago.https://t.co/IUNkPcLC8T pic.twitter.com/XGlIJB7EV5

— CZ 🔶 Binance (@cz_binance) November 9, 2022

Conclusion

What we’ve learned from back-to-back bad events in the crypto space is to not trust centralized exchanges, and to avoid centralized exchange coins that offer trading discounts and rewards in exchange.

FTT is one of those coins that have zero utility again BNB is a utility token I’m not comparing BNB with FTT.

FTX don’t learn from the Luna crash they both are the same because both native tokens are used as collateral

Use Defi exchange for trading if you want to save funds use cold storage wallet don’t trust centralized exchange.

Meme tweet of the day

https://t.co/zBKU98Nmef pic.twitter.com/S1PyYnqpBx

— Do Kwon 🌕 (@stablekwon) November 8, 2022