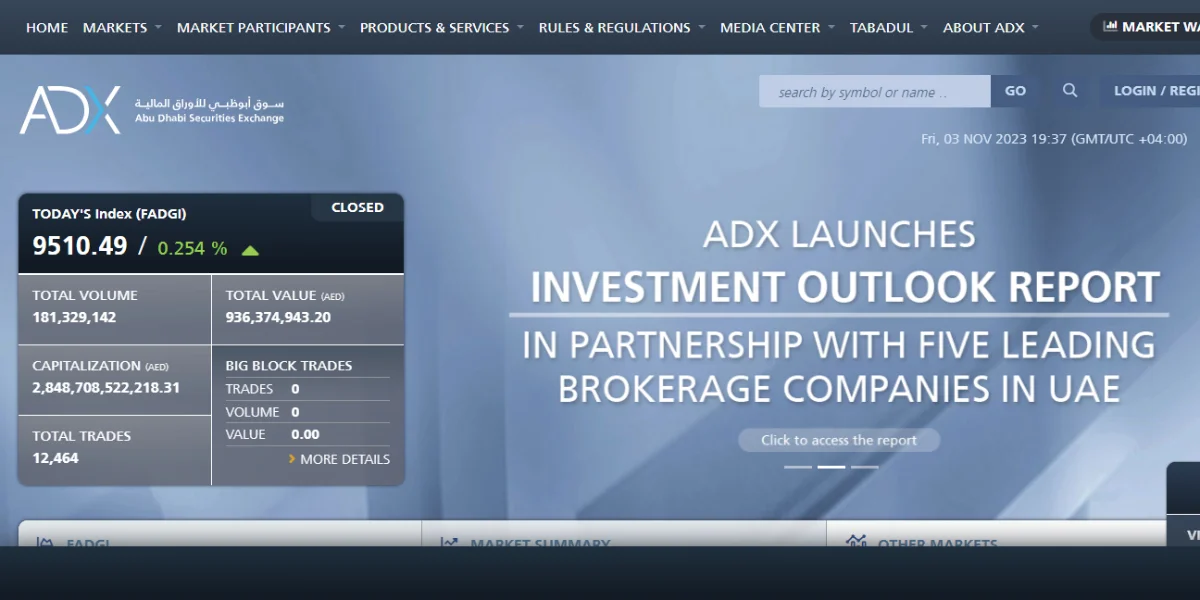

In an exciting regional collaboration, the Abu Dhabi Securities Exchange (ADX) and HSBC Bank Middle East Limited have come together to pioneer the development of digital fixed-income securities. This landmark initiative marks a significant step forward in introducing a wider array of capital market applications to the Middle East.

This groundbreaking partnership harnesses the unique strengths of both ADX, the rapidly growing exchange in the Middle East, and HSBC, renowned for its expertise in investment banking, capital markets, and blockchain technology.

Abdulla Salem Alnuaimi, CEO of ADX, emphasized the growing importance of digital assets in the future and ADX’s commitment to being at the forefront of this innovative wave.

Stay up to date with the latest news. Follow Crypto Avanza on WhatsApp Channels

According to Alnuaimi, ADX and HSBC are poised to explore a framework that will facilitate the availability of digital assets, such as digital bonds, on HSBC Orion, the bank’s digital assets platform. Additionally, these digital assets will be listed on ADX, marking a significant leap forward in the digitization of financial instruments in the region.

Mohamed Al Marzouqi, CEO of HSBC UAE, shed light on their digitization efforts, saying, “HSBC is embracing technology, particularly blockchain, on a large scale to enable the issuance, custody, and trading of digital assets. This capability is set to enhance efficiency and open up new and innovative opportunities for investors. The collaboration between HSBC and ADX leverages HSBC Orion, our proprietary digital assets platform, and our combined expertise in capital markets and custody, to bring this exciting development to the market.”

It’s important to note that digital bonds are financial instruments created and managed using blockchain and smart contract technology, with the goal of streamlining processes in capital markets. By utilizing blockchain technology, a wider range of assets, including equity, fixed income, real estate, and private equity, can be tokenized, making ownership of these assets more accessible to a broader range of investors and increasing the accessibility of securities markets. This collaboration between ADX and HSBC represents a significant step forward in advancing financial technology in the Middle East and beyond.