BNB Coin is dumping because everyone on Twitter is talking about Binance FUD—what is the cause of the world’s number one exchange’s FUD?

The story begins after Mazars releases Binance Reserve’s “overcollateralized” audit report. In this report on December 7, the audit firm found that its users held a total of 575,742.4228 BTC, which is worth $9.7 billion. It also found that it has enough BTC and wrapped BTC to cover 101% of these funds.

The CEO of Binance share the report and said “Audited proof of reserves. Transparency.” Now so what is

Audited proof of reserves. Transparency. #Binance https://t.co/IClZxTYaWp

— CZ 🔶 Binance (@cz_binance) December 7, 2022

So why is everyone talking about Binance FUD?

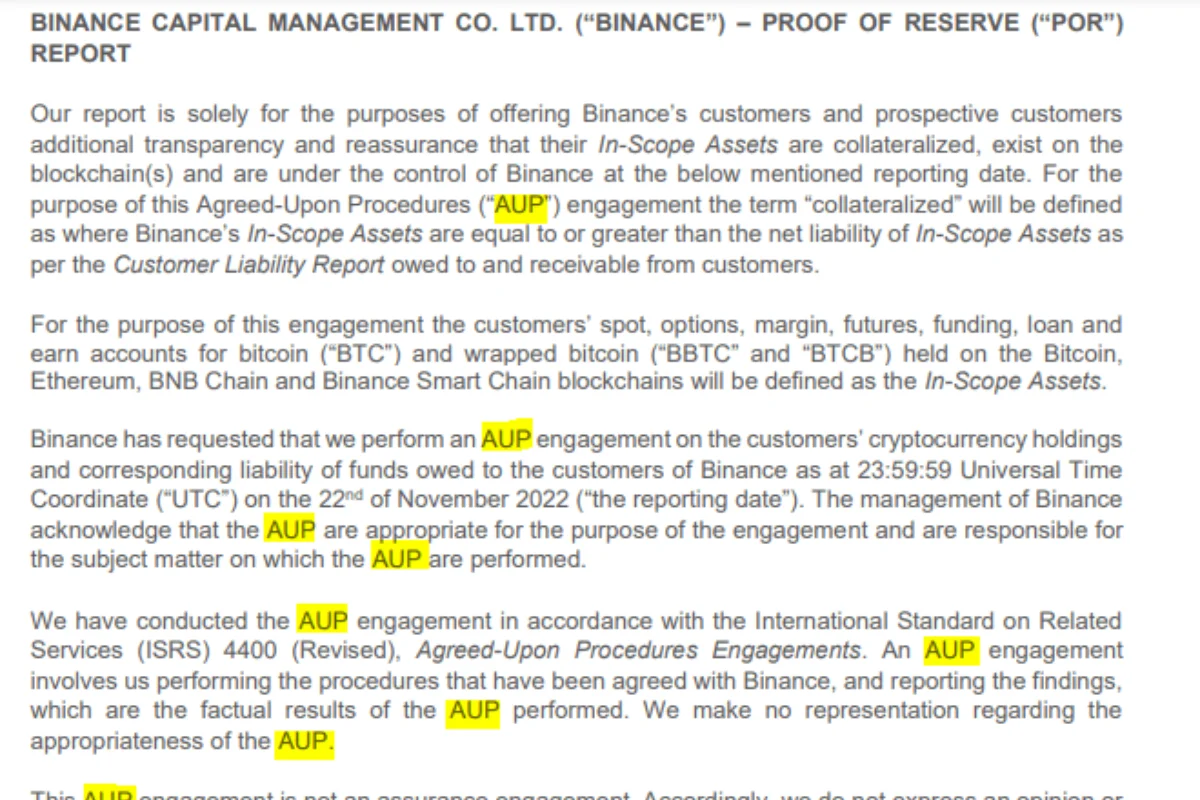

I want to draw your attention to one thing in the audit report, This report is based on AUP which is called Agreed Upon Procedure. The auditor’s report on the findings is usually restricted to those parties who developed the agreed-upon procedures because of the specificity of the desired results.

“An AUP engagement involves us performing the procedures that have been agreed with Binance.” said Mazars in the report.

Here is a Wall Street Journalist article that raised a big red flag on Mazars’ audit report.

WSJ Article on Mazars Proof Of Reserve Audit

A recent report from the Wall Street Journal says that Binance’s finances remain a mystery, even though the company has been trying to be more open about them.

The previous week, auditing firm Mazars released an ” audit ” report, saying the exchange’s reserves are fully guaranteed. Users of the first centralized exchange hold approximately $9.7 billion, and the company covers 101% of the aforementioned funds.

Douglas Carmichael, who used to be the head auditor for PCAOB, says there are questions about whether the funds are secured enough. The report doesn’t give “an assurance conclusion,” he says.

Former SEC Regulator Raised “Red Flag”

John Reed Stark is teaching Data Breach Response and Cybersecurity Due Diligence at Duke Law. Stark alleged that the recent “report doesn’t address effectiveness of internal financial controls, doesn’t express an opinion or assurance conclusion,” and also shared his experience, saying, “I worked at SEC Enforcement for 18+ yrs. This is how I define “red flag” and warn that Binance failed because it “doesn’t vouch for the numbers.”

Binance’s “proof of reserve” report doesn’t address effectiveness of internal financial controls, doesn’t express an opinion or assurance conclusion and doesn’t vouch for the numbers. I worked at SEC Enforcement for 18+ yrs. This is how I define “red flag. https://t.co/6oEqmArjS9

— John Reed Stark (@JohnReedStark) December 11, 2022

In Response Kraken Exchange Founder Jesse Powell also raised concerns about World’s number one crypto exchange he said “The “collateral” accounting trick is exactly how FTX played solvent as well.”

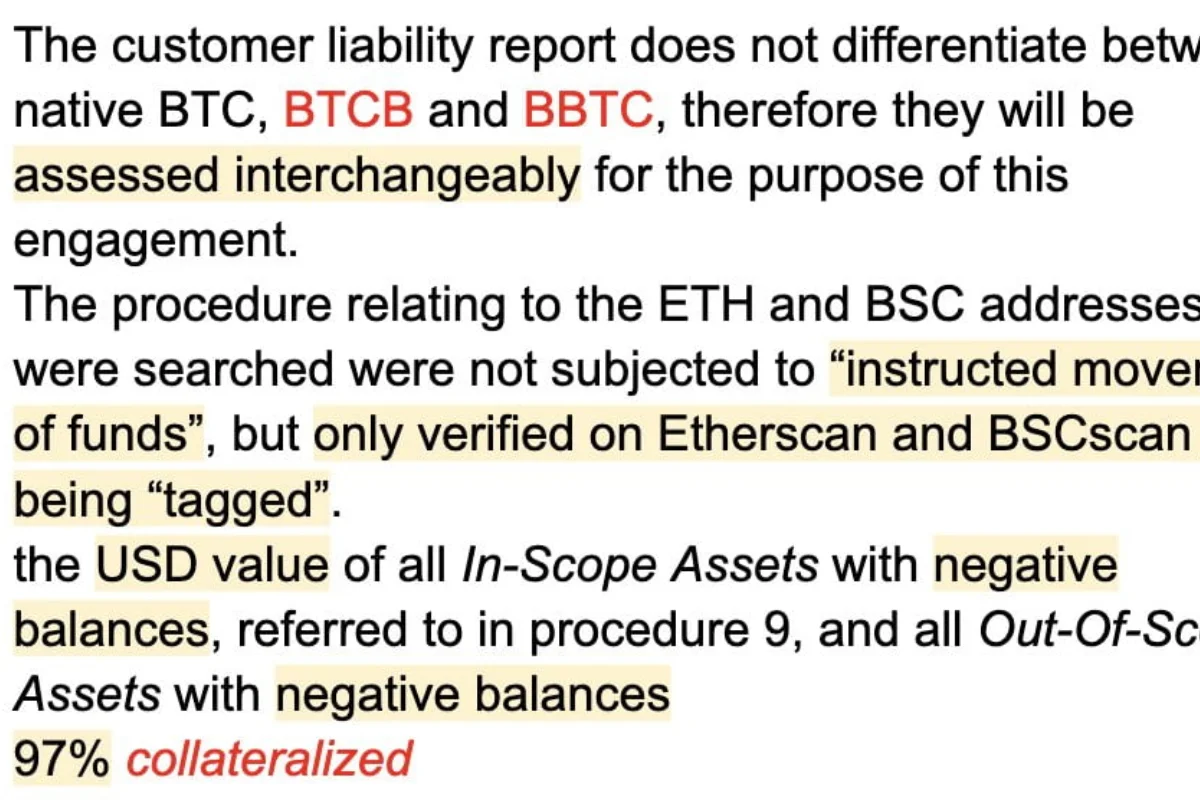

he also points out they prove collateral rather than reserve “Big red flag for me is that this seems to be more of an attempt at proving collateral rather than proving reserves.” Jesse claimed Binance are insolvent “They even admit to be insolvent with regard to actual assets owed vs tokens controlled,” said in a Twitter statement

Read More: Kraken Recently fires 1,100 global workforces based on Crypto Winter

CEO of Kraken Rise Serious “Red Flag”

Jesse Powell mentioned Mazars’ audit report and stated “ok, I’ll give you a hint. This is just the easy stuff that says this OBVIOUSLY is not a traditional Proof of Reserves, and should immediately have had actual journalists digging.”

“Why use collateral value? Why negative balances included? No wallet signing? Who issues BTCB & BBTC?”

and he also points out that the audit report is nothing in which liability is not included

A reminder:https://t.co/YNBFcBwm47

— Jesse Powell (@jespow) December 8, 2022

On December 10 he also mention “Another misleading “PoR” AUP (not an audit) released today.” added more “Apparently, there is no consistent process used across exchanges. Again, the process strays far from the original spec”

This Binance FUD is actually created by CZ Binance so let’s me you with proof of CZ tweets

“Binance FUD” Changpeng Zhao Tweets

After FTX melded down, the CEO of Binance introduced “Proof of Reserve” because of customers’ fund assurance, so other exchanges also introduced Proof of Reserve. So we see the drama of Crypto.com cold wallet transfer of $400 million on Gate.io, and the company says it sent 320,000 Ethereum by mistake to another exchange.

On Crypto.com Drama CZ tweet which affects CRO token price

CZ rise a point if the crypto exchange transfer user fund which sign of a problem”Stay away” “Stay SAFU”

So why i shared this tweet because is directly related this FUD story When Mazars conduct AUP audit on then Binance Exchange tweet

“As part of our Proof of Reserves (PoR) process, Binance is working with a 3rd party auditor to provide proof of ownership.”

“You will likely see some large transfers between Binance’s owned wallets throughout the day as a result of this.”

and lastly, end with the last tweet then you decide If Binance is doing right or “Binance FUD”