Fantom [FTM], a blockchain protocol known for its speed and scalability, has witnessed a remarkable resurgence in its decentralized exchange (DEX) volume.

Despite facing challenges like the shutdown of one of its DEX platforms, Fantom has not only bounced back but also achieved impressive growth. In the past seven days, Fantom’s DEX volume surged to an astounding $143.1 million, marking a staggering 1302.7% increase from a mere $10.2 million just a week ago, according to digital asset research firm ASXN.

The driving force behind this remarkable growth has been identified as SpookySwap, an Automated Market Maker (AMM) within the Fantom ecosystem. SpookySwap plays a pivotal role by providing constant liquidity for traders, allowing them to seamlessly trade against a liquidity pool.

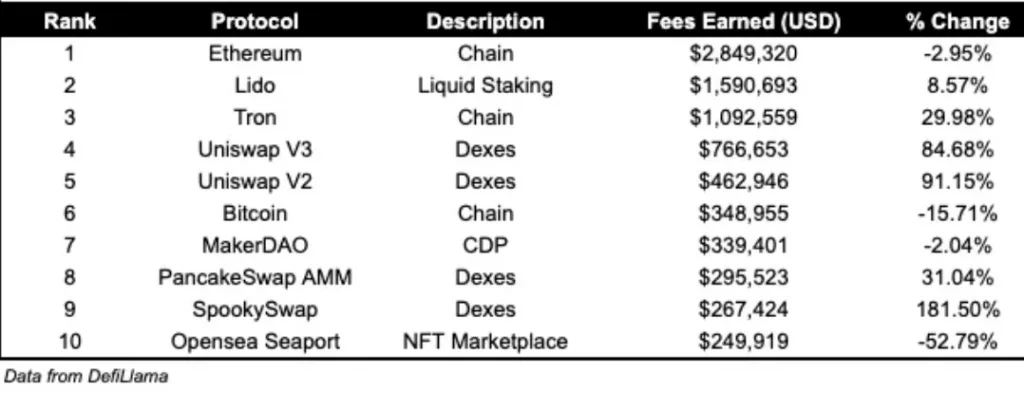

Data from DefiLlama reveals that SpookySwap recorded an impressive 181.50% increase in fees generated, ranking it as the ninth-highest fee earner in the DeFi landscape. This substantial increase in DEX volume signifies a newfound stability within the Fantom protocol.

Resilience amidst challenges

Not long ago, Fantom had to grapple with the unexpected shutdown of SpiritSwap, the former leading DEX on the network. The SpiritSwap team cited operational cost challenges and a significant multichain hack as the reasons for their exit from the sector.

Read More: SEBA Hong Kong Poised to Pioneer Licensed Crypto Banking

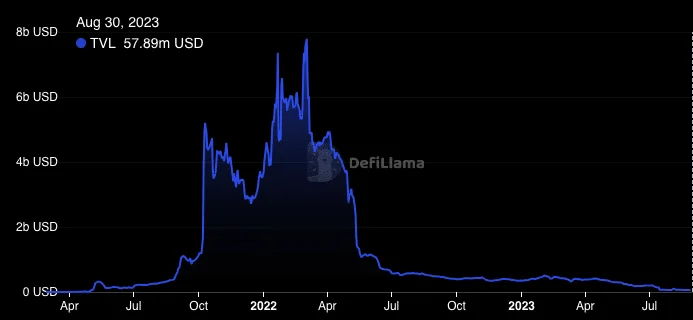

While this incident initially had a negative impact on Fantom’s Total Value Locked (TVL), the protocol has made significant strides in the past 30 days, with TVL now standing at $57.89 million, reflecting an 8.34% increase during this period.

TVL is a crucial metric that measures the value of assets locked or staked within a protocol. A higher TVL is generally seen as a sign of trustworthiness for a decentralized application (dApp) and the underlying protocol.

Therefore, Fantom’s gradual increase in TVL suggests that it is successfully regaining the trust of market participants, leading to a surge in unique deposits into chains operating under its protocol.

Development and social dominance

In addition to the surge in TVL, Fantom is demonstrating promising signs in terms of development activity. Data from Sentiment indicates that Fantom’s development activity is on an upward trajectory.

Development activity is a key metric that gauges the rate of code commits to public GitHub repositories associated with a project. An increase in this metric signifies a strong commitment from developers to improve and enhance the network, and this is indeed the case with Fantom.

Furthermore, Fantom’s social dominance has also witnessed an uptick, currently standing at 0.226%. Social dominance measures the percentage of discussions and attention one asset receives compared to others. This increase in social dominance indicates a growing interest and attention being redirected toward Fantom.