Nexo has come under the radar for its high-yield-bearing crypto products when the broader market remains weak. The concerns come a month after the co-founders assured that the platform is solvent. Tera UST 20% APY is also not sustainable, Nexo’s double-digital yields can’t be sustainable.

Crypto Lender Nexo Sued for Allegedly Blocking $126M

Crypto lender Nexo is being sued in the London High Court by a group of investors. The investors allege that the firm blocked them from withdrawing over $126 million worth of crypto. They claim that Nexo froze their accounts after they sought to remove their assets from the platform.

In response Nexo stated “the claimants withdrew all their assets from the Nexo platform and they are not disputing this fact.”

Over the previous month, the California Department of Financial Protection and Innovation has filed a “cease and desist” order against Nexo. Agency says Earn Interest Product from Nexo was not a qualified security. After the SEC fined BlockFi, U.S. account holders couldn’t add any more money to their accounts.

But BlockFi Relaunches Crypto Yield Product in US After Paying $100M Fine to SEC.

It’s almost time.

Certain US clients—verified as accredited investors—will soon be able to earn interest on their digital assets with BlockFi Yield. pic.twitter.com/FUCTFZ6PhB

— BlockFi (@BlockFi) November 7, 2022

Now Crypto firm BlockFi filed for Chapter 11 bankruptcy protection in the wake of FTX’s bankruptcy. It’s the latest in a series of crypto bankruptcies, following FTX, Voyager and Celsius.

NEXO Paying 10% on Stablecoin in this bear market

Nexo currently offers a stablecoin yield of 10%, while Defi yields only 1%.Prior to Terra’s demise, Luna was also offering a double-digit APY of around 20%; this is insane, and now this bear market is being accompanied by bad events such as Luna, FTX, and now BlockFi’s bankruptcy.

LeClair says that Nexo makes more money than it promises because it borrows money from users who put up collateral. ” The problem here is that in a system with no lender of last resort, the commercial bank model on crypto rails can blow up, quickly,” he said.

The comment in this below-the-fold tweet shows Bankless David Hoffman crying after experiencing back-to-back crypto fraud, but they promote Nexo, which offers 16% APY. LOL

The irony of David Hoffman crying over scams in the space while his podcast is sponsored by Nexo who offer up to 16% yield. pic.twitter.com/9jIZUw20z4

— GANDALF (@BTCGandalf) November 27, 2022

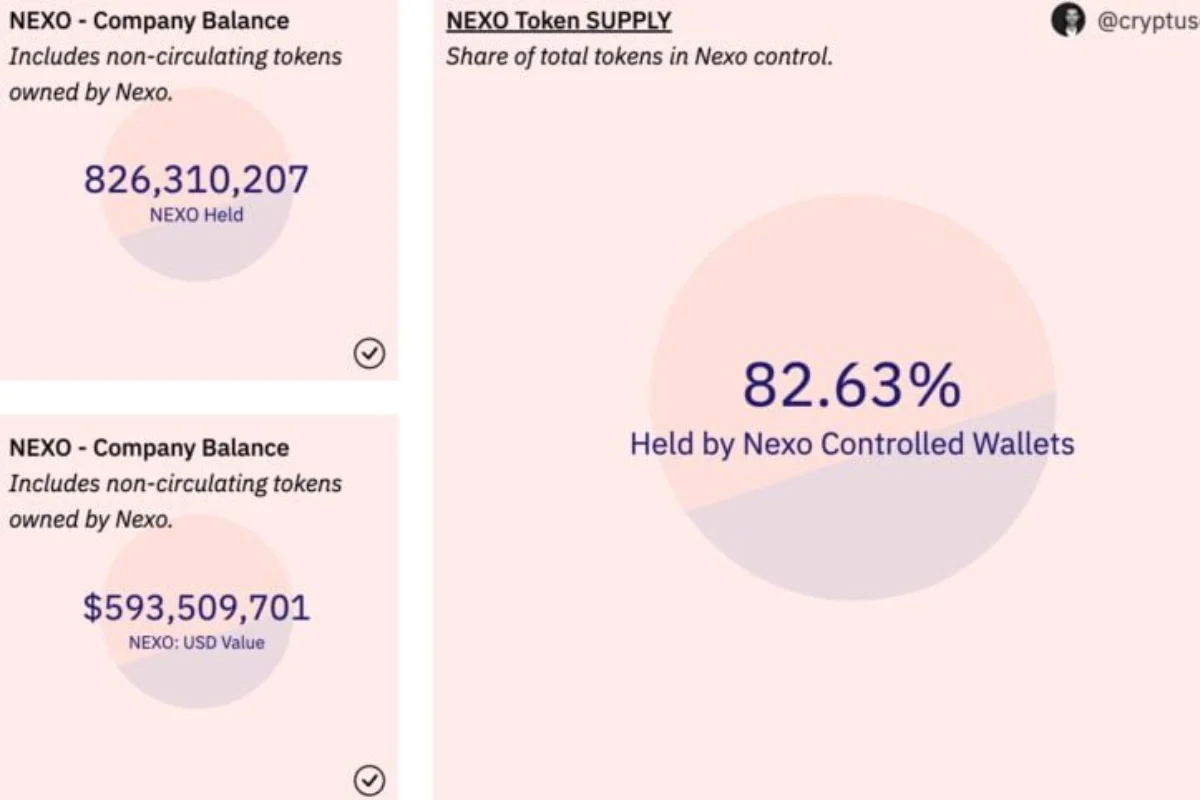

According to the dune dashboard, The company controls over 82% of the total supply of its tokens. This means that the platform’s backing could be compromised if liquidity issues mount.

Nexo fear choping the crypto market

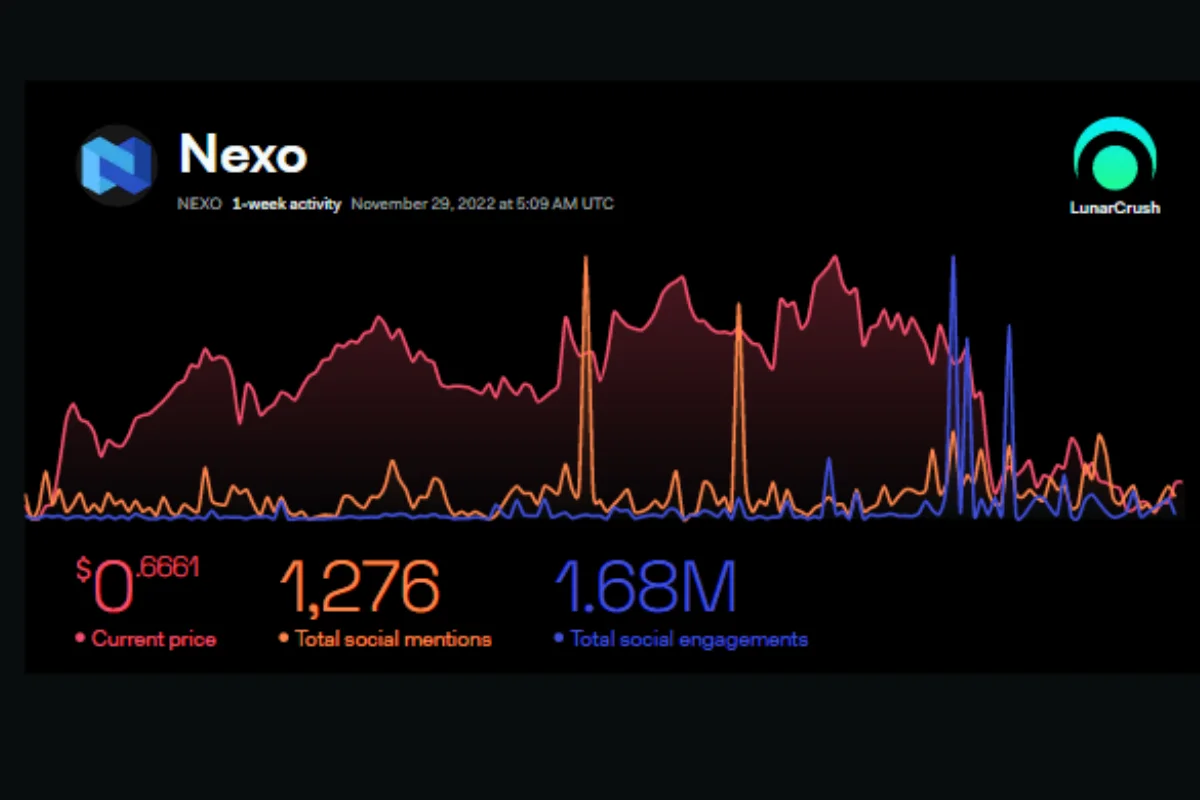

According to the Lunarcrush Nexo, social activity is at an all-time high as a result of the following Blockfi Chapter 11 bankruptcy. According to the chart, the price drops when social volume is high, indicating that everyone is afraid of Nexo, which is why social volume is against the price.

Wrapping Up

The FTX exposure is still becoming clear, and the market’s mood is still bad. Coinmarketcap shows that the total value of the cryptocurrency market is still close to $826 billion at the time of this writing. Stay away from the so-called Crypto Lender, which is a Ponzi scheme, because the Yields come when the token becomes more mint; this is referred to as a higher Yield, which is never sustainable because the Yield becomes more inflationary and illiquid.