Andre Cronje a software architect with 20 years plus of development experience, says that the Fantom blockchain project he advises has a positive cash flow and brings in more than $10 million a year.

Why Fantom Token Price Rising

Just a recap about fantom (FTM) is a layer 1 decentralized, permissionless, open-source smart contract platform for decentralized applications (dApps) and digital assets as like Ethereum. The network competes with Solana, Avalanche, and Polygon to take over the market share of Ethereum.

Cronje shared a medium blog post on Monday 28-11-22 about Fantom: an inside financial peek at being a “crypto company” After he shared company’s journey of revenue the price of Fantom rising everyone on Twitter about talking about fatom defi revenue.

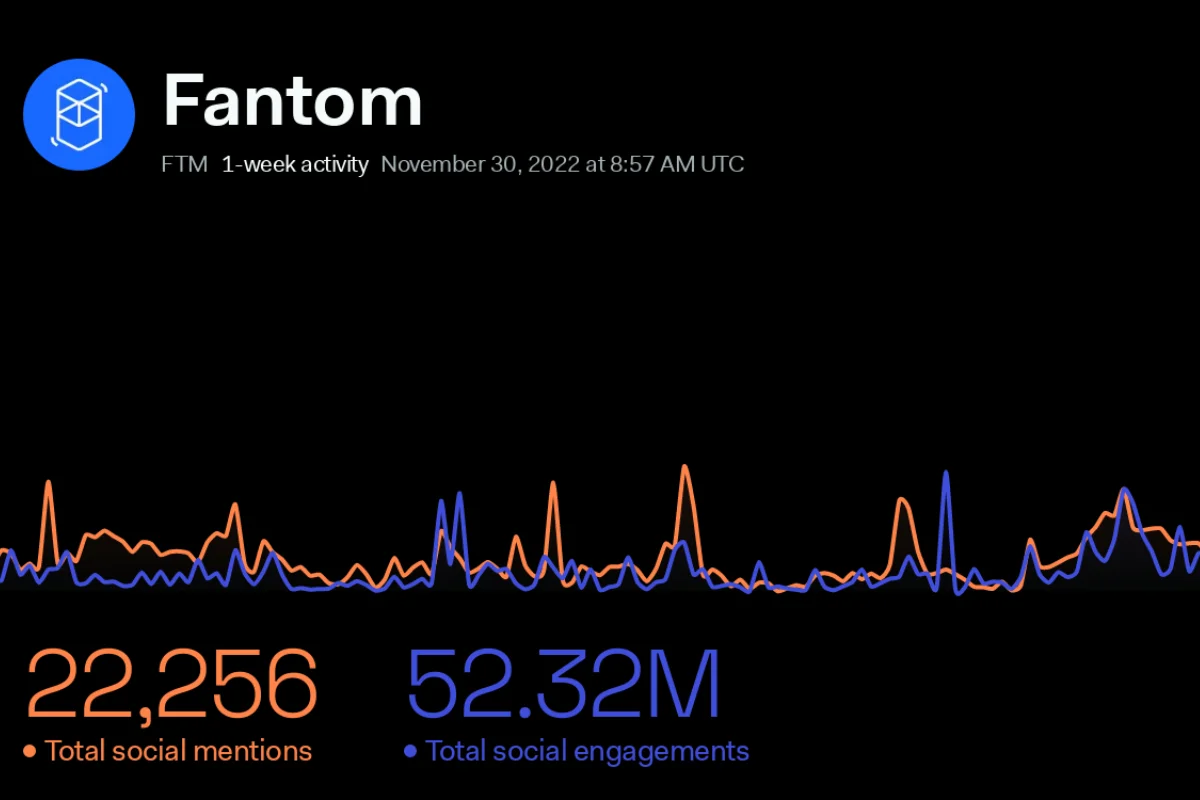

According to the above Lunarcrush dashboard, the fantom social volume has increased significantly after a long decline. When Cronje shared the post on the Twitter price of FTMUSDT was 0.188 at this time I’m writing price is around 0.24 which is a 27% increase in just 2 days so what’s the impact on the FTM token after this blog post let’s discuss in deep dive Also what is the next price move of FTM.

Andre Cronje’s blog post about Fantom Revenue

According to the blog post, Andre Cronje is a long-serving figure in the DeFi space. Fantom’s reported treasury is made up of around 450 million FTM ($85.7 million), which is 17.6% of its total supply. The current total supply of Fantom is 2.55 billion, according to CoinMarketCap. There’s also $100 million in stablecoins and $100 million in other cryptocurrencies not mentioned in the blog post, as well as $50 million in non-crypto assets.

This blog shows the non-profit defi organization’s financial journey, fantom was founded in 2018, and the officially mainnet lunch on December 2019.

Who is Andre Cronje?

According to the coinmarketcap, Andre Cronje is one of the most influential people in the DeFi space. He is best known for creating Yearn Finance and Keep3rV1, as well as his participation in other high-profile DeFi projects. His last five years have been spent building bespoke FinTech solutions and leveraging blockchain technology.

- In 2020:

- Launched Yearn (YFI) and Keep3rV1

- Binary Options partnership with Hegic

- Pickle & Yearn ferment co-operation dill

- Yearn & Cover merger

- PowerPool & Yearn ecosystem partnership

- Yearn & Cream v2 merger

- Yearn & Akropolish merger

- Yearn & Sushiswap collaboration

Fantom Journey

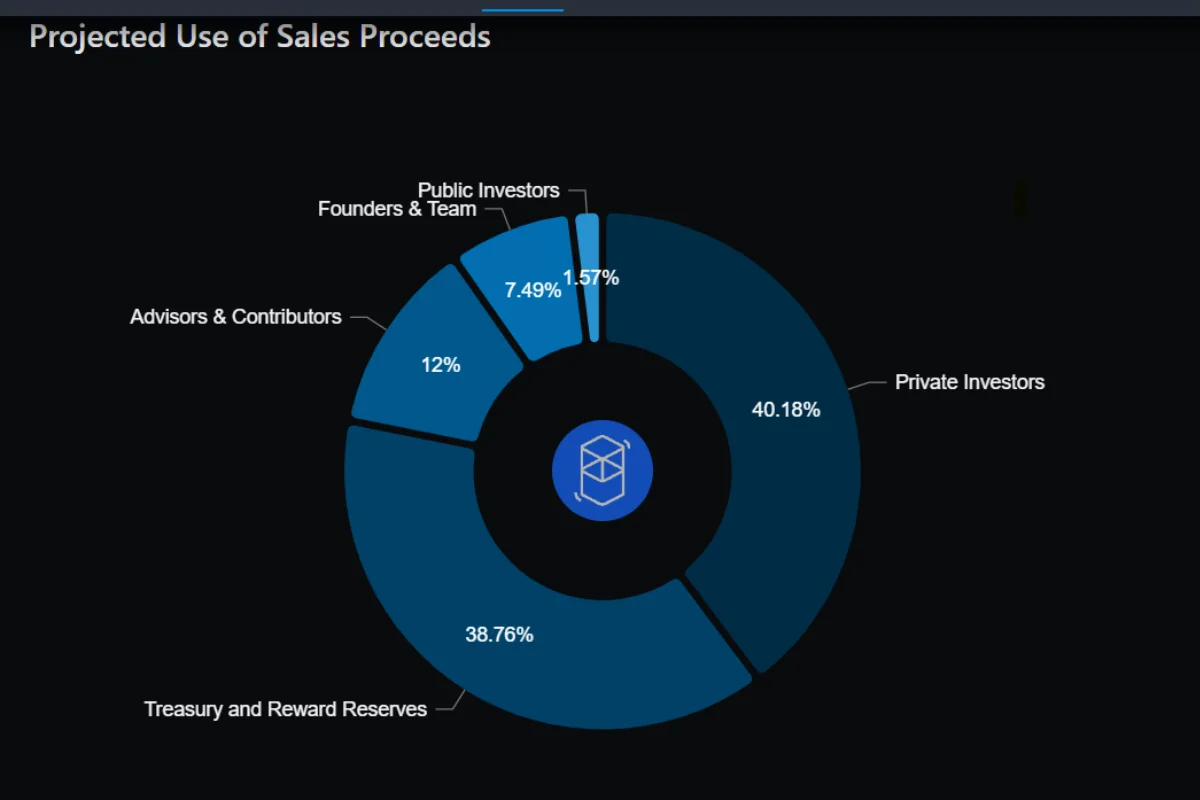

They raised $40 million from initial token sales in June 2018, mostly in Ethereum at a price of $450-750 (at this time ETH around 1$260)

Company Major costs include listing fees for exchanges that cost more than $3 million and “sponsorship fees” for “influencers” that cost more than $0.5 million. They decided to never pay for influencers or exchange listings again. They start to save a lot of money. a complete stop to all marketing. Hire only the people you need. All of the C-level staff had their pay cut, and some even worked for free. The company’s annual salary burn rate is less than $0.5 million. Reported

Dec. 2018: Fantom sells the ETH for a much lower average price than it raised. When Fantom is operational, the company has less than $5 million left in the Treasury.

Cronje said They use their own profit from FTM token and start building in decentralized finance, company goal is to grow to $8 million by the end of 2020. They

In June 2020 Company made DeFi strategies like comping, they do Yield farming on Compound and Synthetix earning from sUSD and COMP tokens in which they earn $20k to $40K per week.

Fantom turned down the RPC service provider because it would cost 8 million dollars to integrate. At the moment, Fantom’s Treasury has 40 million dollars, which is the same as when they originally raised.

Cronje said that by February 2021, the Fantom Foundation would be making more than $1 million per week. Back then, the crypto market was booming. DeFi tokens were going through the roof, bitcoin was getting close to $60,000 for the first time, and yield farming was still a good way to make money.

In the same month, the project sold 81.5 million FTM to Sam Bankman-Fried’s trading firm Alameda Research for almost $35 million average FTM token price of around ($0.428831 per token) (Now at this time of writing FTM worth is half) and another 10.4 million FTM to Blocktower for $5 million.

Cronje said that Alameda wanted to take part more, but Fantom decided not to. He also said that the team turned down offers from an unnamed exchange to pay $300 million for a listing and an NFT marketplace to pay $100 million for integration.

Fantom Revenue Model and Earning

At this time FTM is down more than 88% year to date, dropping from $2.25 to less than $0.24. FTM’s market cap is now less than $650 million, ranked 63rd by coinmarketcap

But Fantom’s total value locked (TVL) is suffering even more than its token price. As per Defillama, the total value look of FTM is worth $458 million in USD, which is down from $8.07 billion on March 3-22. As per the market cap of FTM tokens, 75% of the tokens are looked at and 25% are unlocked. which is good sign of any defi project.

Income / Revenue

Cronje said with an average daily transaction fee of 30,000 FTM this earns us >1 million / year. The average fee per transaction is less than $0.005. Fantom runs 9 validators, for a total stake of 60 million FTM. This earns us ~4.1 million FTM / year and “Fantom earns ~$5.9 million from various defi strategies across the Fantom and Ethereum ecosystems.” “We are cash flow positive.” “We are still scaling up.”

With transaction fees, validator and delegate earnings, and other income, Fantom makes more than $10 million a year. However, this number does not include capital gains tax and seems to be based on FTM’s current valuation.

Read More: Nexo High-Yielding Crypto: The Next Luna After the FTX Collapse?

Cronje Thought

Cronje says that Fantom now chooses to buy its own token instead of trading it for partnerships, integrations, or listings on crypto exchanges. He also said most Layer 1 project founders own 50% to 80% of token supply because their projects are based on token sales, which is a finite model because they sold coins to run the business and earn profit from token holdings when prices are high. This model works on the bull market, not the bear market.

he claimed Fantom owned less than 3% of the token supply and “today we own more than 14%.” as per above Cronje said $450 million FTM in treasury which is around 17.6% supply of FTM tokens as per today’s circulation supply which is $2.55 billion. “We prefer buying our token, we don’t “sell” our tokens for “partnerships”.

he said “Blockchain companies don’t make revenue” Being a validator isn’t part of the foundation. We do it because we believe in the network, and we get paid for it.

“On the other hand, Messari indicates Fantom’s founders, team, and advisors collectively garnered roughly 20% of the token supply, more-or-less in line with Avalanche and Solana. Polygon’s team however kept almost 42% of the initial supply,” as per blockworks

“We building the most scalable and robust L1. Network revenue is something unique to Fantom, but again, these fees aren’t planned for the foundation, they will become platform revenue for dapps launching on Fantom. This again, is not a core business, any dapp launching on Fantom will earn these, not us. Decentralized finance & treasury management, while historically has proven very successful for Fantom, is not our core business.” said Cronje

“Blockchain companies, realistically, only make money by selling their token, these are finite models.”

Companies spend lots of time comparing infinite and finite models three questions they solved for ourself

- “what impact does this partnership make in 10 years”

- “how do we sustain this action in 10 years”

- “If we pay for this launch, how long before this partner simply deploys on other chains”

he compared another new blockchain like Solana, and many newborn L1 chains, Fantom operational for over 4 years and we oldest L1 after Ethereum. “We have a proven track history of technological advancements and delivery.”

“If your entire revenue model is selling your token, you are doing a disservice to yourself, your blockchain, and your supporters.”

“If defi didn’t exist, we would likely not be operational today. I believe the same is true for many companies out there.”

“Crypto is dead. Long live crypto.”

What is the next price move of FTM?

As per the weekly timeframe FTMUSDT market structure is heavy downtrend but we wait for this weekly closing if FTM holds $0.22 support then the next price upward target is around $0.30 otherwise when the price is down the support also on the bottom is around $0.10

Conclusion

Cronje’s article indicates Fantom is on its way to earning from Defi strategies across the Fantom and Ethereum ecosystems, indicating Fantom has the ability to run itself as a Defi foundation. Fantom Treasury owns 18% of its own token supply and does not sell tokens; rather, they validate the network and earn a network fee, which is a good strategy.

According to this article, most new L1s make money by selling their own project tokens rather than through validation.