2022 was the worst year for crypto after the Luna meltdown. Every company that had exposure to Luna stablecoin went bankrupt, and in November, famous companies went bankrupt, which caused DCG’s parent company, Genesis Global Trading, to file for Chapter 11 bankruptcy protection.

#Terra is the '#Genesis' of #bankruptcies in the #crypto industry in the current bear market.

Who knew one coin could have such a powerful impact? 🤭 pic.twitter.com/elzFR3P1t5

— Satoshi Club (@esatoshiclub) January 20, 2023

Genesis Bankruptcy

Back in November 2022, Genesis was in trouble immediately after FTX collapsed. They had $175 million stuck on FTX and that Company was looking for a $1 billion liquidity injection to keep the company afloat.

Genesis also made large loans to Three Arrows Capital, which is now bankrupt. They loaned $2.3 billion to 3AC despite warnings about its liquidity. Ultimately, the loss was $1.2 billion when the fund collapsed last year.

According to Winklevoss, Genesis lent more than $2.3 billion to Three Arrows Capital, a move which ultimately left the crypto firm with a loss of $1.2 billion once the hedge fund failed in June 2022.

— Cointelegraph (@Cointelegraph) January 10, 2023

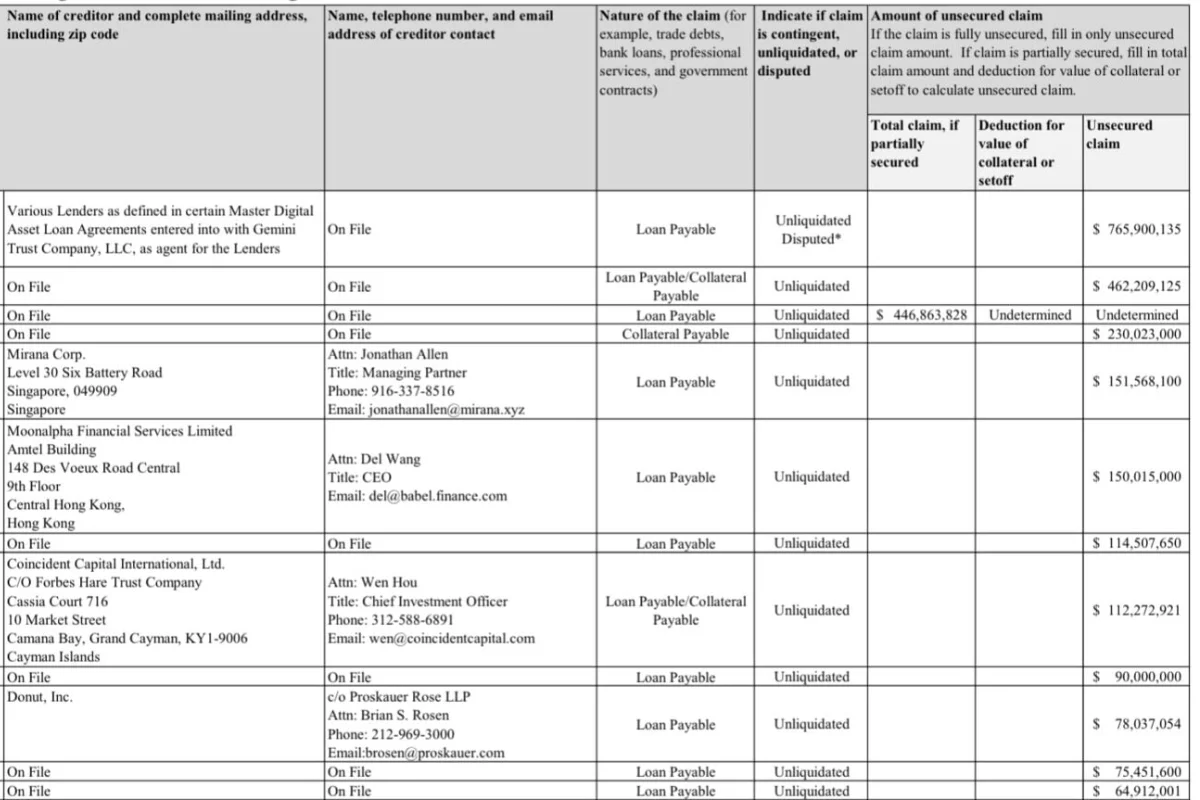

Today, Genesis Global filed for Chapter 11 bankruptcy protection, owing more than $3.5 billion to its more than 100,000 creditors. Gemini Crypto Exchange is the largest creditor, as expected, with an unsecured claim of $765.9 million.

The firm published a list of its top 50 creditors, which include such names as Gemini, Cumberland, Mirana, MoonAlpha Finance, and others. As per the document, Genesis Global owes over $3.5 billion to the creditors on that list.

you can also check this file from the below tweet.https://twitter.com/SimonDixonTwitt/status/1616389082502008832

In November Genesis Global Capital was forced to suspend customer withdrawals, which hurt customers of a yield product offered by the Gemini crypto exchange.

Gemini Crypto Exchange

Gemini Crypto Exchange is the largest creditor that initially responded to the news on Twitter, Writing a thread that “we have been working to negotiate an acceptable solution with Barry Silbert and DCG” but they “continue to refuse to offer creditors a fair deal.” he added

In this thread, Winklevoss threatened to sue DCG CEO Barry Silbert over the repayment of the loan.

5/ We have been preparing to take direct legal action against Barry, DCG, and others who share responsibility for the fraud that has caused harm to the 340,000+ Earn users and others duped by Genesis and its accomplices.

— Cameron Winklevoss (@cameron) January 20, 2023

“Genesis is in negotiations with creditors represented by law firms Kirkland & Ellis and Proskauer Rose” source CNBC

On January 12, the Securities and Exchange Commission charged Genesis and Gemini with allegedly selling unregistered securities in connection with a high-yield product offered to depositors.

This Below twitter thread read this is totally playing the customer fund both Gemini and Genesis

Encourage everyone to read the @Gemini / Winklevoss' response to the complaint filed by Earn members.

This puts into perspective how "crypto-like" banks view their "customers"Customer = lender

Borrower = #Genesis #Gemini = a simple agent executing the wishes of the lender pic.twitter.com/LHj0jOua58— John Cook (@frontrunjohn) January 17, 2023

Genesis bankruptcy is going to reveal the entire crypto leverage cycle.

Enjoy. pic.twitter.com/X9zduPzlQY

— Alfa | ⟁ (Is Hiring for FS Engineer, DM) (@alfaketchum) January 20, 2023

2022 to 2023 Crypto Bankrupt Companies

- Three Arrows Capital

- Celsius Network

- Terraform Labs

- Voyager Digital

- Core Scientific

- Babel Finance

- Hodlnaut

- Genesis

- BlockFi

- Zipmex

- FTX

JUST IN: #Crypto companies that went bankrupt in 2022 and 2023

1- Three Arrows Capital

2- Celsius Network

3- Terraform Labs

4- Voyager Digital

5- Core Scientific

6- Babel Finance

7- Hodlnaut

8- Genesis

9- BlockFI

10- Zipmex

11- FTX— Crypto Avanza (@AvanzaCrypto) January 20, 2023

Meme of Day

Department of Justice(DOJ) protecting users 😂#Crypto #Bitcoin #Genesis #FTX pic.twitter.com/B37woDtTmb

— Wise Advice (@wiseadvicesumit) January 19, 2023