The cryptocurrency crisis went into high gear on Friday as Silicon Valley Bank’s (SVB) failure caused some of the industry’s core plumbing to go chaotic.

Before Silicon Valley Bank failed On Wednesday Silvergate, a central lender to the crypto industry, said on Wednesday that it was winding down operations and liquidating its bank. The stock plunged more than 36% in after-hours trading.

After the Silvergate Bank collapsed, Bitcoin was sharply down 2.23%, trading at its previous 4-week level. The total crypto market cap was rejected by the 1T, and within hours, $50 billion was wiped out from the market.

Now that Silicon Valley has collapsed, bitcoin was down sharply by 12% and the SPX fell by 4.5%, which is trading around its previous May 2022 level. US stocks and crypto have now lost over $2 trillion in market cap in under 24 hours.

The whole situation is about Bank Run, Silicon Valley Bank’s 48-hour collapse led to the second-largest failure of a financial institution in US history. Let’s dive deeper into what happened with SVB and why Crypto Stablecoins are di-stable (debugged). especially USDC and DAI.

Silicon Vally Bank (SVB) Crash Explained

Crypto Avanza finds Ming Zhao’s tweets that help you easily understand the disaster of Banks.

Silicon Valley Bank—the 16th largest US bank with $212 billion— just crashed 60% in 1 day and fell 22% post-close. The stock is halting.

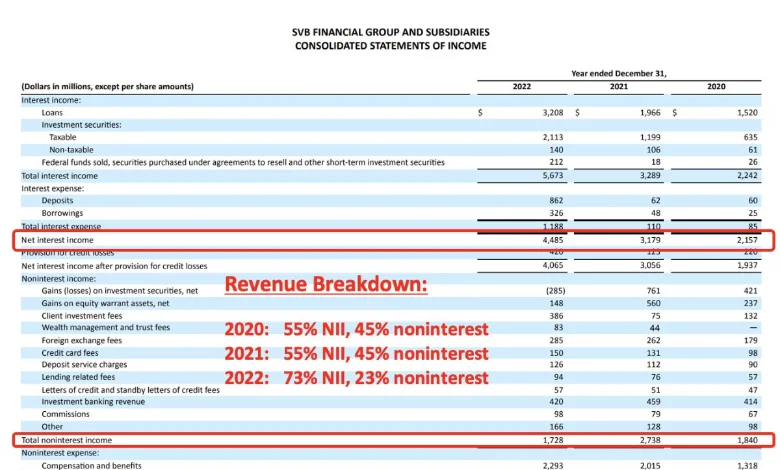

SVB is a bank. Banks earn money by accepting deposits and lending them out at higher interest rates. This spread between interest earned on loans and interest paid on deposits is called NII (net interest income).

NII is SVB’s #1 profit source: ~73%

SVB’s NII comes from 2 main sources:

- Interest on loans to startups

- Yield from fixed-income investments (treasuries, MBS)

So SVB loses $ when:

- Startups default on debt

- Interest rates rise and SVB must sell its FI investments at a realized loss

Additionally, when interest rates rise, SVB’s cost of funds (i.e. interest-bearing deposits) increase while its interest income on loans might remain fixed (if it invested primarily in FIXED-RATE USTs!) This leads to a decline in profitability, ie lower “NIM” (net income margin)

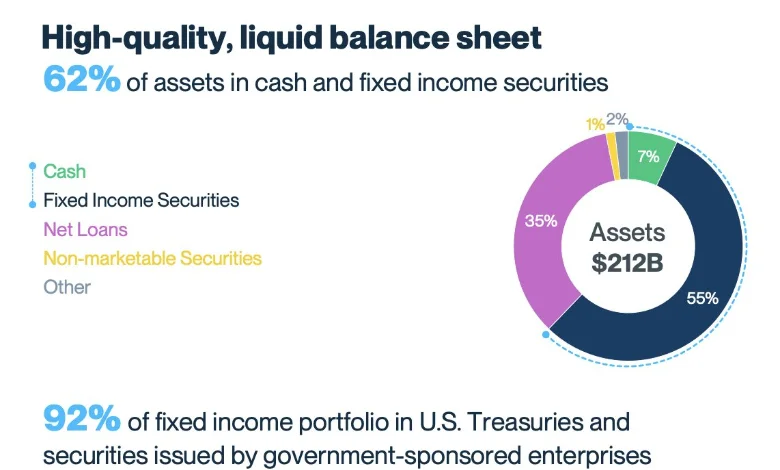

In 2021, SVB saw a mass influx in deposits, which jumped from $61.76 billion at the end of 2019 to $189.20 billion at the end of 2021.

As a result, they purchased a large amount (over $80 billion!) in mortgage-backed securities (MBS) with these deposits for their hold-to-maturity (HTM) portfolio.

97% of these MBS were 10 years or longer, with a weighted average yield of 1.56%.

The problem is that as the Fed raised interest rates in 2022 and continued to do so until 2023, the value of SVB’s MBS fell dramatically. This is due to the fact that investors can now obtain long-term “risk-free” bonds from the Fed at a 2.5x higher yield.

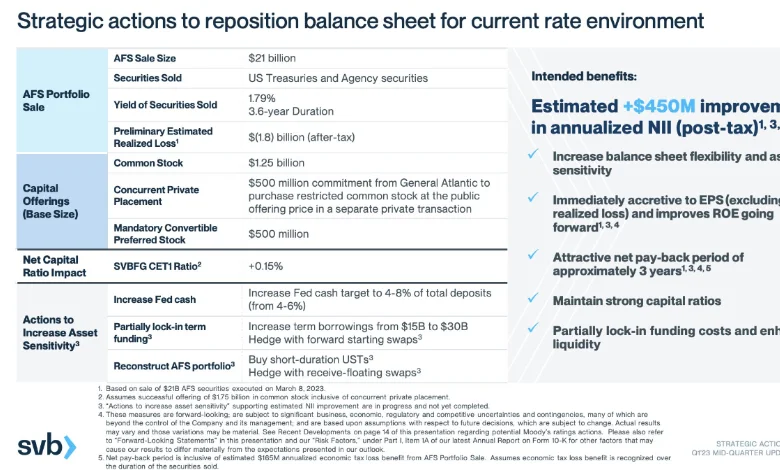

On Mar 8, SVB declared a $1.8B writedown on a $21B sale of almost its entire AFS (available-for-sale) fixed-income portfolio. That’s as big as SVB’s net income for 1 fiscal year! To cover such a big hole, SVB is now raising $1.75B in common + pref stock.

On Friday SVB’s capital raise failed. Now the US regulator has closed the bank.

Let’s say everyone suddenly withdraws. SVB will have to fire-sell its assets. What next? 90% of SVB’s assets are FI and loans. Say it recovers: 80% of FI (80% x $117.4B = $94B) and 80% of loans (80% x $70B = $56B) So $150 billion in available liquidity for $173 billion in deposits. Pretty tight.

It is tough to ask people to be calm in situations like this, especially after Silvergate and FTX. Silicon Valley Bank Failure Sparks Concerns of Financial Contagion in the US Banking System and Crypto Markets

14- Bank stocks plummeted right now:

First Republic Bank $FRC -63%

Silicon Valley Bank $SIVB -86%

Western Alliance Bancorporation $WAL -60%

Signature Bank $SBNY -80%

PacWest Bancorp $PACW -80%

— Muhammad Humair Qureshi (@BiWithHumair) March 10, 2023

Bank stocks plummeted right now:

- First Republic Bank $FRC -63%

- Silicon Valley Bank $SIVB -86%

- Western Alliance Bancorporation $WAL -60%

- Signature Bank $SBNY -80%

- PacWest Bancorp $PACW -80%

Why Crypto Affects On Silicon Valley Bank (SVB) Collapsed

USDC Stablecoin owns Crypto firm Circle reveals $3.3 bln exposure to Silicon Valley Bank

After the circle statement, USDC is the second-largest stablecoin by market capitalization, with an hourly market cap of 43.7 billion USDC sharply down, and 8 billion was wiped out.

Meme Of the Day

— Elon Musk (@elonmusk) March 11, 2023

The story is still underdeveloping