Intro

As all know something about crypto but we don’t know how the crypto coin owner made money from his crypto project here we talk about how the layer 1 blockchain business module works

We discuss here Ethereum BNB Solana and many other smart contracts deploy platform called layer one blockchain

What Is Blockchain

Blockchain Technology invent in the early 1990s blockchain is just a distributed data storage network but in 2008 Satoshi Nakamoto make blockchain technology useable with his proof Of Work Consensus

This Consensus validates each block that’s solved the fraud issue and double spending issue then this public blockchain was used as a digital currency in 2009

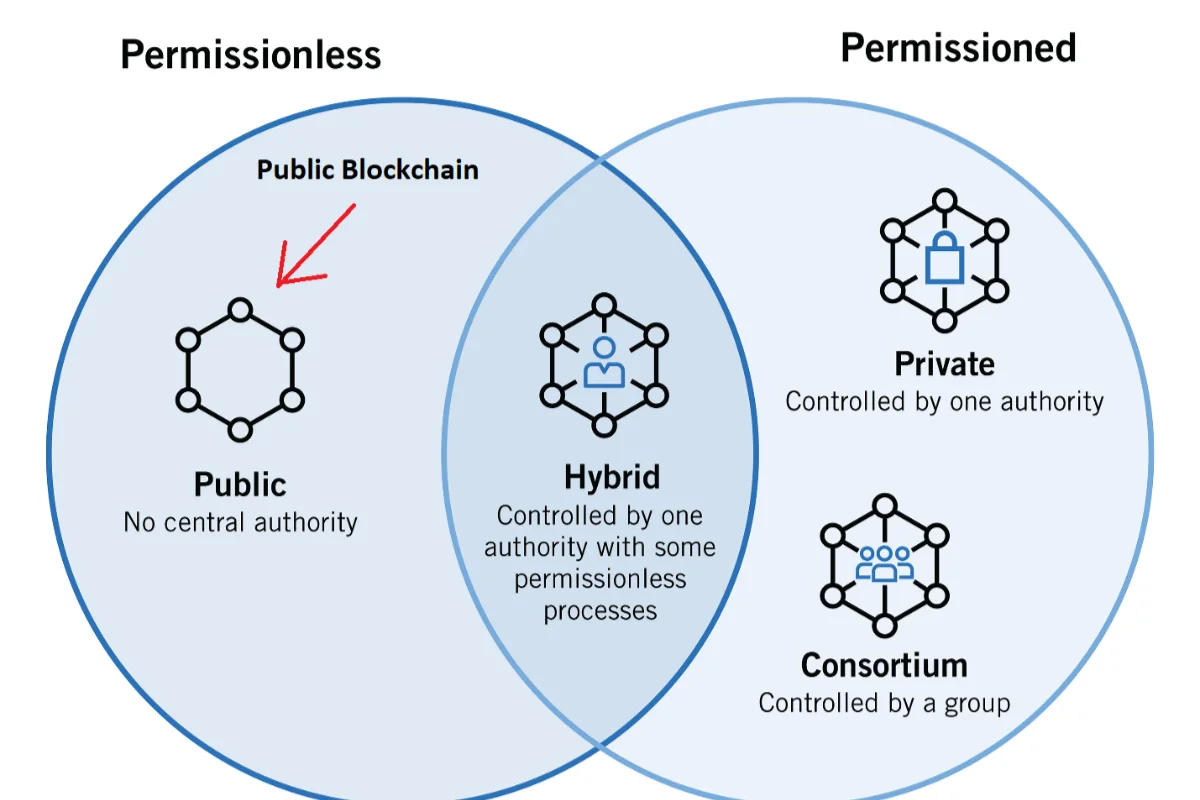

Now Blockchain has four types

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- Consortium blockchain

We discuss in this article a public blockchain platform with smart contract functionality, public blockchain is open source anyone have internet can access this type of blockchain

This type of chain permissionless layer 1 blockchain which has smart contract functionality

A public blockchain is like a people vote for a presidential candidate in which someone is against the candidate or someone like.

What Is Layer 1 Blockchain

Layer 1 blockchain is a settlement layer for example Ethereum is an L1 chain in which NFTs, Tokens, and Web3 Apps (Dapps) build on it to work in a decentralized manner because L1 is a public chain which has no central point this chain provides security and decentralization to the Dapps.

How L1 Chain is different to other L1 chain

Smart contract platforms compete in three key areas: scalability, security, and decentralisation. All three things are called blockchain trilemma and the interesting point is the blockchain can’t give three things in one chain.

That’s why the L1 chain needs a scalability solution to scale the network.

The real two examples in crypto Ethereum before Merge is truly decentralized and secure but not scalable and here now Eth is converted to the POS network that’s why the ETH network is semi-decentralized because Ethereum wants to achieve the scalability issue

Binance Coin Chain is given security and is highly scalable but not truly decentralized

How L1 Chain Works

Layer 1 is the fundamental base network of a blockchain platform. It executes all on-chain transactions and therefore acts as a public ledger’s source of truth.

All top L1 smart contract deploy blockchain is working on POS consensus the working mechanism is the same for all but the priorities is different you know what blockchain trilemma is that’s why some L1 chain focus on security and decentralization or some security and scalability but here the same thing is all L1 chain is security because secure the chain is priority

So why is decentralization is compromised due to scalable the network the decentralized network means that every person uses the internet to validate the network so if any fast update required the huge number of nodes will decrease the scalability that’s why Binance Coin BNB chain is highly scalable because they create the high criteria to become a BNB chain validator that’s why BNB is not truly decentralized.

Ethereum has more than 500,000 nodes at the time of writing and BNB has just 21 nodes that’s why BNB is more scalable because the no. of nodes has a minimum which is why BNB is fast and scalable

So how does the L1 chain owner earn money from it?

How Layer 1 Blockchain Business Module Works

The Layer 1 blockchain founder team earn money in three ways as I think but we discuss all possible way how to earn founders from his L1 ecosystem

The first possibility founders sell their token when they create the project, they hold tokens holding then the price of the token appreciate the founder teams sell the token to earn money from holding

Second, they run nodes to earn gas fees from the transaction

The third is to earn gas fees from dapps

The world’s top layer 1 smart contract platform is Ethereum’s own we first discuss how Ethereum works to earn money from it.

Discuss Ethereum Network from the beginning

In 2013 Vatalik Burtine shared though about the layer 1 blockchain which is different from the Bitcoin Concept because Ethereum work like a decentralized Internet, anyone can build Dapps on it and Bitcoin is just used for digital currency.

In 2014 Vitalik and some early investors founded Ethereum Foundation a non-profit org Then July the Ethereum Foundation launched ETH sales in which they minted 72 million tokens which a price per BTC convert 1337 ETH tokens which is more than 30 cents.

In the layer 1 blockchain of the Ethereum Network, the first block mined ETH tokens around 72 million back, and its name is the genesis block.

Genesis is known as the very first block or zero block which is mined by the founder like the Bitcoin genesis block mined in 2009 by Satoshi Nakamoto

In crypto, the economy is called Tokenomics so here we discuss ETH token economics from the beginning

Ethereum Economic Distribution

The non-profit org sales raised 31,529 BTC in exchange for 60 million ETH tokens sold in crowd sales and the remaining 12 million ETH (20% of the initial supply) were allocated to the Foundation and early Ethereum contributors. Source Messari

- 3 million were allocated to a long-term endowment

- 6 million were distributed among 85 developers who contributed before the crowd sale

- 3 million were designed as a “developer purchase program” which gave Ethereum developers the right to purchase ether at crowd-sale prices.

At the start of the sale and for fourteen days the price was set so that one bitcoin bought 2,000 ethers. At the end of the 14 days, the amount would decline linearly to a final rate of 1,337 ether, which meant that one ether was worth 0.0007479 bitcoin or about 30 cents at bitcoin prices in September 2014.

Vitalik got the biggest share of the contributors’ endowment at about 553,000 (0.553 million) ether which is 0.7% of the total supply worth is ($0.165 million) at this time when ETH’s initial price around 30 cents.

Ethereum Foundation would publish a blog post that said, “according to Wikipedia, Ethereum is rated as the second-biggest crowdfunded project in the history of the internet, sitting proudly next to the first occupant that raised over $70 [million], but over years, not 42 days.”

To see how they gain profit when selling on his project tokens so let’s discuss in brief with facts

1- Token selling Business

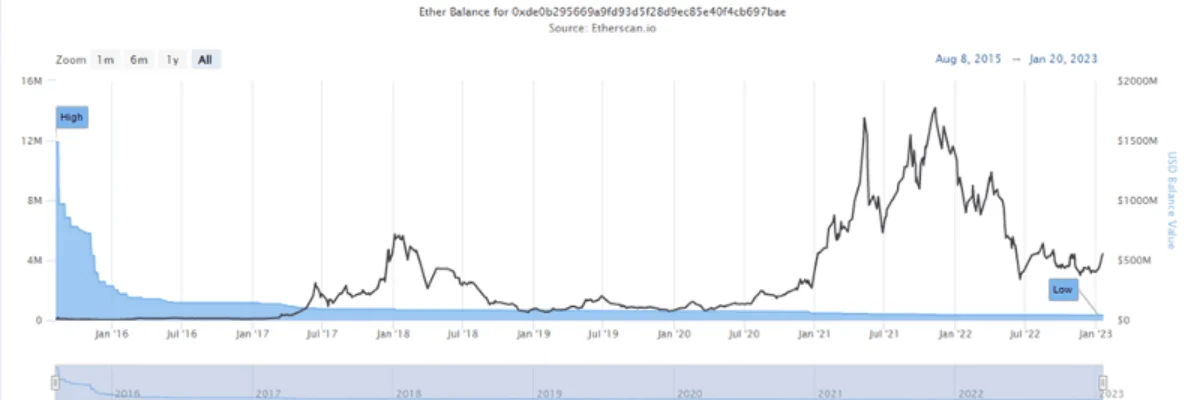

Ethereum Foundation have 12 Million Token reserves When the ETH token was first minted today the ETH reserve was down all-time low which is 0.33 million ETH ($520 million) almost 97% of ETH was gone from the foundation reserve

In August 2018, when Vitalik Buterin shared his Ethereum holding address on Twitter, he was holding 333,520 ETH, and we discussed above that Vitalik received the 553,000 ETH when Ethereum was first minted. Maybe Ethereum’s founder sold 219,480 ETH.

Though that doesn't just include sales, it also includes some gifts and charity donations.

— vitalik.eth (@VitalikButerin) October 10, 2018

and Buterin is a confirmed HODLer: the last time he sold ETH was in August 2020, when he sold 13,333 ETH for $5.2 million — back then, the price was just below $390.

*I* sold ETH at ~$700, or about half the top (actually, both sold and donated). The *ethereum foundation* sold at ~$1200, and that money has gone into devs and grants since then.

— vitalik.eth (@VitalikButerin) August 17, 2020

Vitalik Butrein’s wallet status at this time shows 251,156 Ether in his wallet. We know that when Eth was first minted, Vitalik had 553,000 Ether and that the Ethereum founders now own half of that ETH holding.

| Vitalik Address | Name | Eth Balance |

| 0x220866B1A2219f40e72f5c628B65D54268cA3A9D | vb3 | 244,001 |

| 0xd8dA6BF26964aF9D7eEd9e03E53415D37aA96045 | vitalik.eth | 7,561 |

| 0xAb5801a7D398351b8bE11C439e05C5B3259aeC9B | vb | 1 |

| 0x1Db3439a222C519ab44bb1144fC28167b4Fa6EE6 | vb2 | 6 |

| Total ETH | 251,569 | |

Buterin sold Ethereum when the price went above $4,000 at the 2021 all-time high.

Below is the mentioned YouTube video, in which Anchor asks about Vitalik, did you short Ethereum?

Buterin stated, “Ethereum Foundation to sell about 70,000 ETH, basically at the top,” and he praised the decision to sell, saying, “it was a good decision.” and last he decline they didn’t short on ETH

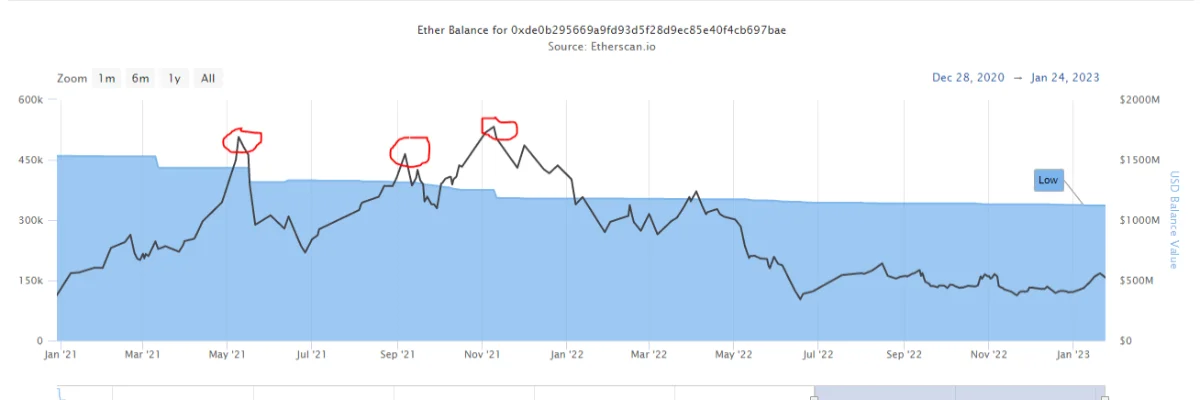

When the Eth price surges in 2021, the ETHdev account will gradually decrease the asset. On May 9, the account was worth 430,141 ETH and the ETH token price was $3,900; the balance was $394,787 ETH at the time of writing, and it was currently worth 336,271 ETH, an all-time low.

On May 9 to today, when the ETH price surged and the ETHDEV address 93,870 ETH was gone, the red circle in the above image shows that the Ethereum Foundation moved the supply to sell, as the above YouTube video by Vitalik proves. They also confirmed that they sold ETH on top, as the average ETH price according to the above red circle is around $4,195. So, the total amount sold is around $393 million.

Hence, proving that this evidence shows the Layer 1 Blockchain made money to sell its token.

So if you believe in Ethereum or any other layer 1 crypto project, please don’t hold coins and always sell them when the price goes up.

2 & 3- Validator and Gas Fee Business

Validator nodes are the foundation of blockchain, and they profit whether the cryptocurrency market grows, falls, or moves sideways. A validator node is a node that keeps a copy of the blockchain’s history and validates new transactions.

Layer 1 project Ethereum (ETH), Cardano (ADA), Solana (SOL), Avalanche (AVAX) and Polkadot (DOT) are some of the most popular networks for running a validator node.

At this time Ethereum network active validator has 506,201 and a total of 16,198,057 ($25.1 Billion) Ether was staked.

On 28 November 2022, Fantom team developer Cronje shared an article in which he shared the Fantom Foundation Revenue this article gives an idea that layer 1 earns money from the validator node to his network.

“Cronje said with an average daily transaction fee of 30,000 FTM this earns us >1 million / year. The average fee per transaction is less than $0.005. Fantom runs 9 validators, for a total stake of 60 million FTM. This earns us ~4.1 million FTM / year.” Source Crypto Avanza

Fantom Foundation earns 5.1 million FTM/ year from validator nodes and gas fees and the total amount of FTM they hold which around 14% supply.

According to the FTMScan total of 64 validators and the Fantom Foundation own 14% of the validator nodes.

If we see the Ethereum Network which has more than 50 thousand validators, let’s suppose Ethereum Foundation owns 20% validator nodes which is only 10 thousand nodes and per node has 32ETH requirement so 320,000 ETH were staked in the network, so the year income they made according to staking calculator is more than 22 million (131,717 ETH) per year at this time of writing.

Calculate the Ethereum foundation earing from these insights

131,717 ETH per year

93,870 ETH sold per year

To my analysis, the Ethereum foundation earns almost $415 million dollar per year and much more at this time I have just limited data so if anyone owns about more please share it with me.

If you like this insight I’ll definitely cover a lot more L1 chains and if you want Vitalik’s total holding and business outside of crypto I’ll definitely cover those things

Read my story: 2022 Is The Best Year For Learned Crypto & Money

sources links which help me to analyse these things