As we all know, the market is directly related to the crypto narratives; in 2020, the Defi narrative boom in the crypto space, in just under one year the DeFi tokens market volume from $700 million in January to $15 billion in December.

Because the narrative is pumped hard, this $15 billion crossed $180 billion in the 2021 bull run, and we all know the next huge narrative is NFT. Starting in 2021, sales in Q1 are around $1.2 billion; by the year’s end, total sales in just one year are at $25 billion.

In 2023, Chatgpt is hyping and the AI narrative will drive the market, but there will be many more narratives. We discuss all of this in this article, so let’s take a deep dive.

What are Crypto Narratives?

Crypto narratives refer to the prevailing stories, ideas, and beliefs within the cryptocurrency market that shape investor sentiment and influence investment decisions. These narratives can be based on various factors, such as technological advancements, market trends, government policies, or the actions of influential individuals within the cryptocurrency space.

Crypto narratives can be a powerful force in the market, as they can influence the demand for certain cryptocurrencies and impact their value.

Here I discuss the top 20 narratives in crypto! and also the best Twitter thread, which explains much more about the narrative; in addition, the top tokens for each project Some of the narratives listed are older but have huge potential to grow in the future; some might be exhausted, and some are yet to explode.

1- Perpetual DEXes

In 2022, DEX derivatives exploded, with leading players Derivatives are financial contracts whose value is determined by an underlying asset, group of assets, or benchmark.

Derivatives are the world’s largest financial markets, with notional values ranging from $600T to $1Q.

According to the Marketmediagroup, the crypto derivatives market reached a peak of $4.96 trillion in 2021, and the majority of crypto trading in February 2022, 62.7%, was in derivatives rather than spot markets.

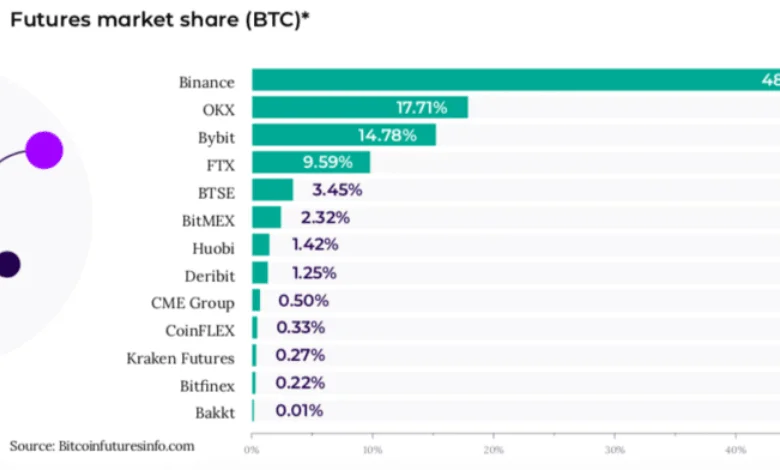

Binance, the largest cryptocurrency futures exchange, accounted for nearly half of the total volumes (47.3%).

Following the FTX exchange meltdown, the market lost trust in other large exchanges, prompting crypto enthusiasts to migrate to their decentralised exchanges for perpetual trading. Here are some high-potential projects.

Read More in the below Twitter thread

/ Top Players

One of the easiest way to quantify the growth of a narrative is to look at its top players.

So far, the top DEX derivatives like @GMX_IO, @GainsNetwork_io, @dYdX, and @perpprotocol are doing incredibly well.

— Viktor DeFi 🛡🦇🔊 (@ViktorDefi) January 30, 2023

2-Layer2 (L2)

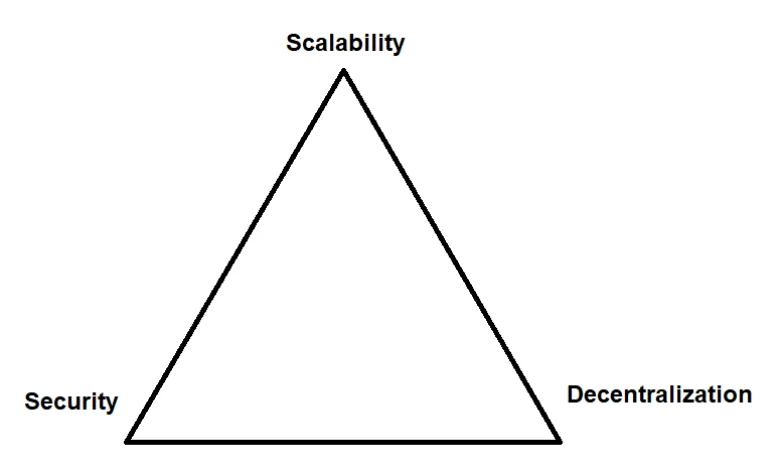

We all know crypto projects are based on blockchain, and blockchain has three components: decentralisation, security, and scalability. The amazing thing is that all three components don’t fit in one blockchain; this is called the blockchain trilemma. So some crypto L1 projects provide decentralisation and security, while others provide scalability and security; the more decentralised the blockchain, the less scalability it has, and the less decentralised it is, the more scalable it is.

So the Layer 1 chain wants all of the things in one blockchain, so that is why the Layer 2 phenomenon is presented, the polygon is the best example of an L2 solution which is a side chain of Ethereum that provides scalability.

here is some best project which scales the Ethereum blockchain and keep eye on it

With the coming of Shanghai and the sudden run up of tokens and LSDs, an obvious narrative for 2023 is @ethereum Layer 2s.

Who is winning the L2 wars and what does on chain wallet and transaction data tell us? I crunch data with @DuneAnalytics 📊 to help you find out!

👇

0/18 pic.twitter.com/tto3JAa0n2— Defi_Mochi (@defi_mochi) January 14, 2023

Read More: Layer 1 Blockchain Business Module: The owner sells tokens to earn money

3-Real Yield

This narrative is brewing in DeFi. It’s called “Real Yield”, where protocols payout yield to users based on revenue generation.

Real Yield is classified as yield derived from the generation of “real” revenue, as opposed to revenue derived from token emissions. Real Yield operates reflexively: More revenue = more yield paid to users and vice versa.

Here are some favourite real-yield projects that generate yield via actual revenue generation.

There's a hot new narrative brewing in DeFi.

It's called "Real Yield", where protocols pay out yield to users based on revenue generation.

🧵: My TOP 10 picks to capitalise on this growing sector, and how they could become the pillars of the next cycle. 👇

— Miles Deutscher (@milesdeutscher) August 9, 2022

4- Liquid Staking Derivatives (LSD)

Liquid Staking Derivatives (LSDs) are a type of token on the Ethereum mainnet that allow users to participate in staking without having to lock up their funds for a long period of time.

By depositing ETH into a smart contract, users can receive an LSD token, which represents their staked ETH and accrues value based on rewards in the network. When withdrawals are enabled after the Shanghai fork, users can redeem their LSD tokens for the underlying ETH along with any additional ETH from the staking yield.

LSDs offer users the opportunity to earn rewards from staking while still retaining access to their funds and taking advantage of price fluctuations in the market.

With several main LSDs available, users have the option to choose the one that best fits their needs and investment strategies.

Thread🧵 Liquid Staking Alpha🕵️♂️

Has the liquid staking narrative peaked already, or is it just beginning to take off?

And should you bet on the market leader $LDO or smaller protocols?

I've collected all the data in one place. Get a complete overview in just a few minutes👇 pic.twitter.com/7K5tEC9KaQ

— Thor⚡️Hartvigsen (@ThorHartvigsen) January 4, 2023

5- (Zero-Knowledge) ZK-EVM

The Ethereum network is slow and expensive, so many have tried to create rollups on top of it to make transactions faster and cheaper.

The Ethereum Virtual Machine (EVM) allows developers to write smart contracts in Solidity and makes protocols compatible with the existing Ethereum ecosystem.

ZK-rollups are a faster and cheaper alternative to Ethereum’s Layer 1 network, can be their own independent network, and are part of Ethereum’s scaling plan.

Some important points:

- ZK-rollups are much faster and cheaper to transact on than Layer 1 Ethereum

- ZK-rollups don’t necessarily have to settle back to Ethereum, they can become their own independent Layer One network

- ZK-rollups are a key part of Ethereum’s scaling plan

Here are some great projects in which some have tokens some are ready to lunch

ZK-EVM:

A flurry of ecosystems have recently announced zero-knowledge, EVM-comptabile rollups.

I know, it's a mouthful.

So what do ZK-rollups mean for Ethereum? What does they mean for you as a user? And how could this tech transform crypto?

Today, we take a look:

— Jack Niewold 🫡 (@JackNiewold) July 22, 2022

6- On-chain Option trading

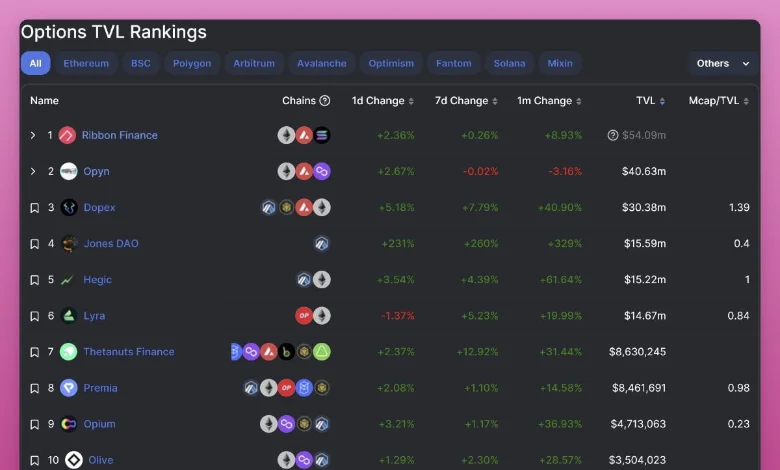

DeFi options are becoming increasingly popular, with 42 protocols listed on DefiLlama and a combined TVL of $220 million. Robinhood’s success with options trading, which accounted for 45% of their fees in 2021, suggests that there is a large market for this type of financial product.

While TVL is not a perfect metric, it is still important for structured options products and liquidity pool marketplaces. Ribbon Finance is currently the leader in DeFi options protocols.

1/ Options trading is one of the most overlooked areas of #DeFi

But it's only a matter of time until they take off.

Here's your chance to catch up and learn what option protocols have to offer: 🧵

— Ignas | DeFi Research (@DefiIgnas) January 31, 2023

7- Liquidity Provider (LP) hedging

Crypto liquidity providers are companies or entities that offer buy and sell-side liquidity to cryptocurrency exchanges. They provide the ability for traders to make a transaction within seconds, increasing their chances of executing trades at desirable prices.

They also ensure that traders can move funds in and out of crypto exchanges with ease due to their sophisticated risk management systems. The top crypto liquidity providers in 2023 are predicted to be:

1/ For crypto LPs, impermanent loss is unavoidable due to volatility (gamma) of assets.

But what if there was a way to long/short gamma? A way to earn extra yield and make impermanent gains?

Enter @Gammaswaplabs – the next primitive that will change DeFi forever

An ELI5 🧵 pic.twitter.com/yvxD3KyLz2

— Winter Soldier ❄️🙋🏻♂️ (@WinterSoldierxz) February 1, 2023

8- Modular blockchains

Modular blockchains are gaining attention as a potential game-changer in the crypto industry. This blockchain architecture separates data, transaction processing, and consensus processing into different modules that can be developed by different parties and then linked together.

This approach allows for more flexibility and customization in blockchain design, potentially opening up new possibilities for innovation in the industry. It is seen as a growing narrative for the next bull run.

Here are some top projects good luck is that the project’s token not releasing yet so keep eye on it

Read More in the below Twitter thread

1/ Modular blockchains could be the key to a whole new world of crypto.

And it's a growing narrative for the next bull run.

What makes them special, and why should you care?🧵

— Ignas | DeFi Research (@DefiIgnas) December 13, 2022

9- Artificial Intelligence (AI)

The crypto-AI narrative is a firestorm! The next bull run is likely to result in 50x overvaluations. Research now and find the next AI.

Read More in the below Twitter thread

The crypto #AI narrative is a firestorm!

50x overvaluations in the next bull run are likely

Research now and find the next AI $ETH OR $BTC

🧵16 AI projects that are on FIRE right now👇 pic.twitter.com/d1cTWsLqiP

— Crypto in Black (@thehiddenmaze) February 8, 2023

10- EigenLayer

EigenLayer is a protocol on Ethereum that introduces restaking, a new method for enhancing security. Restaking allows users to rehypothecate their staked $ETH and extend security to more applications on the network through EigenLayer smart contracts.

EigenLayer’s potential lies in its ability to aggregate and extend crypto-economic security through restaking, and validating new applications built on Ethereum.

No discord. No airdrop announcement. No token details. Not a lot, yet. Real alpha, hidden in Coinbase’s 2023 Report.

Read More in the below Twitter thread

This might be one of the next big things.

New platform @EigenLayer, a "re-staking" solution.

No discord. No airdrop announcement. No token details. Not a lot, yet. Real alpha, hidden in Coinbase's 2023 Report.

🧵 What is Eigen and how it might revolutionize Ethereum: pic.twitter.com/4X5narCMKM

— olimpio (@OlimpioCrypto) January 2, 2023

11- Omnichain

Omnichain is the foundation of a protocol that allows for the simple transfer of assets between chains. Transferring funds from Ethereum to Solana or vice versa.

Keep eye on this emerging narrative in crypto

Utilizing @layerzero_labs the omnichain lending protocol @RDNTCapital $RDNT is getting ready to deploy its v2 and going multichain

Real yield and new defi primitives 👀

— slappjakke.eth 🦇🔊 (@Slappjakke) January 19, 2023

12- Crosschain

As Router gets ready to introduce its Gen III Interoperability Infrastructure,

Let’s dive into some of the current and widely deployed Gen I and Gen II cross-chain technologies, and their advantages/shortcomings 🧵👇 pic.twitter.com/Svt8uGdyZc

— Router Protocol (@routerprotocol) February 9, 2023

13- Privacy

Oasis is building the primitives for Responsible AI — here’s how: 👇🧵

— Oasis Labs (@OasisLabs) February 10, 2023

14- Real World Assets (RWA)

The Real-World asset revolution in Defi is already here, but many aren’t paying enough attention yet. Here’s the current state of RWAs to help you catch the wave.

1/ The Real-World Asset revolution in #DeFi is already here — but many aren't paying enough attention yet.

Here's the current state of RWAs to help you catch the wave 🌊

— Ignas | DeFi Research (@DefiIgnas) January 24, 2023

15- NFT-FI

1) Loading NFTFi Summer, Soon^TM. Based on @alexgedevani honest work. I've created a map for the NFTFi ecosystem. With 300+ projects on the list across different L1s/L2s and NFT verticals. I'm boooolish the future NFTFi sector. There are a LOT more projects that I haven't covered https://t.co/Jv4qKFoeGE pic.twitter.com/8uQk4fF7vR

— Minion (@0xminion) August 24, 2022

16- Gaming/Metaverse

GameFi is set to become the next Hot Space in Crypto

CMC released a GameFi report containing:

• The state of the industry

• Top tokens, games & chains to watchI’ve read it all so that you don’t have to.

Read this to understand everything about the next hot space in Crypto pic.twitter.com/L3NgCMxJg4

— Covduk (@Cov_duk) August 23, 2022

17- Predicting Markets/Gambling

Crypto Narratives Alpha Series 💎 02

DeFi Prediction Markets are arguably the most underrated crypto theses for 2023.

A thread on positioning for the gold rush on DeFi Prediction Markets + some alpha drips for you.

↓🧵

— Viktor DeFi 🛡🦇🔊 (@ViktorDefi) January 16, 2023

18- Soulbound tokens (SBT)

1/ Soulbound tokens will bring mass adoption to #DeFi

Introduced just a few months ago by V. Buterin and his colleagues, they're already here!

Here's how souldbound token works and a few projects building on it🧵

— Ignas | DeFi Research (@DefiIgnas) September 16, 2022

19- Account Abstraction

Account Abstraction is a genuine breakthrough for crypto. It's how we bring crypto to the masses.

But we know that it can be complicated, so here’s our attempt to make it more accessible by explaining 5 features enabled by AA that we’re currently working on…

— Argent (@argentHQ) October 19, 2022

20- Composable Networks

3. Composable protocols

We've already seen over 10 projects joining GMX Ecosystem and building on top of GMX.

In one way or another, all of them are contributing to GMX's success.

— The DeFi Investor 🔎 (@TheDeFinvestor) January 7, 2023

Disclaimer on Crypto Narratives

This is not an endorsement of any of the projects/tokens or crypto narratives listed below. The goal is just to share an exhaustive list of the strongest narratives in this space. This is not financial advice. Just an educational post.